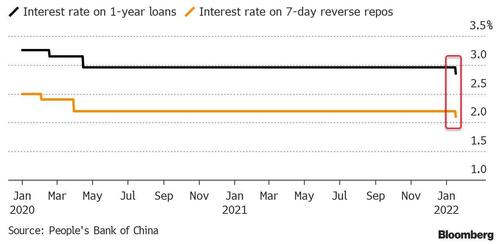

While the US is closed for MLK Day on Monday, the week kicked off with China’s monthly data dump but the PBOC upstaged this by surprisingly cutting rates on its medium term loans ahead of the GDP release. In the first move since April 2020 – which we said would happen one month ago – the PBOC lowered its one-year medium term lending facility (MLF) rate by 10bps to 2.85% from 2.95% and slashed the seven-day repurchase rate to 2.1% from 2.2%.

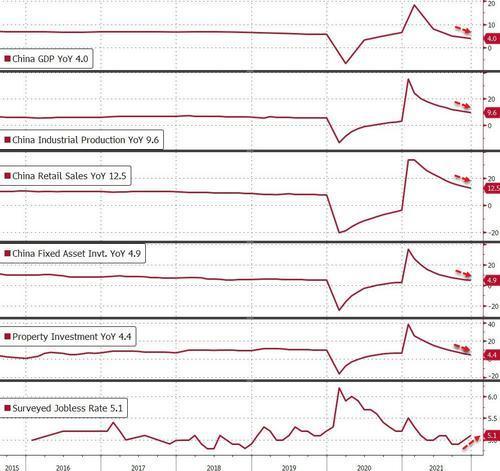

Additionally, as DB’s Jim Reid writes, the central bank injected 700 bn yuan ($110 bn) worth of liquidity via the MLF and added 100 billion yuan of liquidity via reverse repos. Separately, data showed Q4 GDP expanded +4.0% y/y beating Bloomberg forecast of 3.3%. However, the rise was more muted in the last three months (+4.9%) as a real estate downturn combined with strict Covid-19 curbs hit activity.

Other economic data showed that industrial production in China jumped by +4.3% in December from a year ago surpassing market expectations of a +3.7% growth. In addition to this, Fixed asset investment for 2021 advanced by +4.9%, topping market expectations for +4.8% rise. However, retail sales missed expectations (+3.8%) with only a +1.7% gain in December from a year earlier, its slowest increase since August 2020.

In terms of the rest of the week, earnings season will begin to gather some momentum, with 39 S&P 500 companies reporting. The highlights are Goldman Sachs and BNY Mellon tomorrow, before we hear from UnitedHealth Group, Bank of America, Procter & Gamble, ASML, Morgan Stanley, Charles Schwab, US Bancorp and United Airlines on Wednesday. Finally on Thursday, there’s reports from Netflix, Union Pacific and American Airlines Group.

Elsewhere the Bank of Japan will be making its latest monetary policy decision on Tuesday (Monday east coast time) which is unlikely to see much change now but reputable press reports are suggesting they are ready to become more hawkish in the coming months with a credible Reuters story late last week suggested they are prepared to raise rates before inflation reaches 2% (good luck with that). This is still someway off but if the BoJ can become more hawkish then that says something about the global direction of travel for monetary policy.

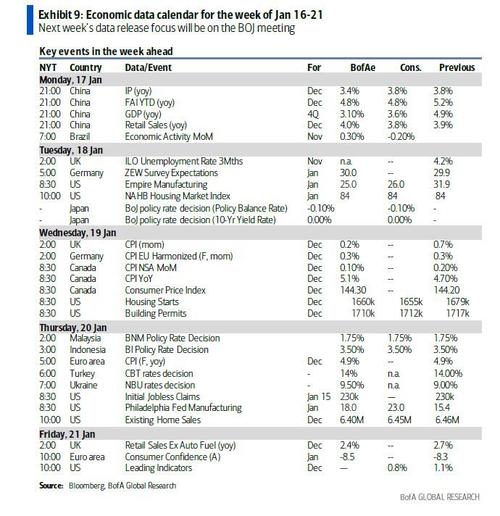

Otherwise on the data front, releases include US housing data, leading indicators and Empire Manufacturing. There is a monetary policy meeting in Japan. CPI data in the UK, the Euro area and Canada. That’ll also be the last CPI reading ahead of the BoE’s next policy decision on February 3, where many economist are expecting a further 25 basis point hike. In Emerging Markets, there are monetary policy meetings in Indonesia, Malaysia, Turkey and Ukraine. GDP and IP data in China.

Here is a day by day breakdown of key events this week courtesy of Deutsche Bank:

Monday January 17

- Data: China Q4 GDP, December retail sales, industrial production, Japan November tertiary industry index

- Other: US markets closed for Martin Luther King Jr. Day

Tuesday January 18

- Data: UK November unemployment, Germany January ZEW survey, US January Empire State manufacturing survey, NAHB housing market index

- Central Banks: Bank of Japan monetary policy decision, ECB’s Villeroy speaks

- Earnings: Goldman Sachs, BNY Mellon

Wednesday January 19

- Data: UK December CPI, US December building permits, housing starts, Canada December CPI

- Central Banks: BoE Governor Bailey and Deputy Governor Cunliffe speak

- Earnings: UnitedHealth Group, Bank of America, Procter & Gamble, ASML, Morgan Stanley, Charles Schwab, US Bancorp, United Airlines

Thursday January 20

- Data: Germany December PPI, Euro Area final December CPI, US weekly initial jobless claims, January Philadelphia Fed business outlook, December existing home sales, Japan December nationwide CPI (23:30 UK time)

- Central Banks: Monetary policy decisions from the Central Bank of Turkey and Bank Indonesia, ECB publishes minutes from December meeting, BoJ publishes minutes from December meeting (23:50 UK time)

- Earnings: Netflix, Union Pacific, American Airlines Group

Friday January 21

- Data: UK January GfK consumer confidence, December retail sales, Euro Area advance January consumer confidence, US December Conference Board leading index

- Central Banks: BoE’s Mann speaks

Finally, looking at just the US, Goldman notes that key economic data release this week is the Philadelphia Fed manufacturing index on Thursday. There are no major speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, January 17

- Martin Luther King Jr. Day holiday. There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends bond markets also close.

Tuesday, January 18

- 08:30 AM Empire State manufacturing survey, January (consensus +25.0, last +31.9)

- 10:00 AM NAHB housing market index, January (consensus 84, last 84)

Wednesday, January 19

- 08:30 AM Housing starts, December (GS +0.5%, consensus -1.7%, last +11.8%): Building permits, December (consensus -1.0%, last +3.9%): We estimate housing starts increased by 0.5% in December, reflecting warmer than usual December weather and increased permits in November.

Thursday, January 20

- 08:30 AM Philadelphia Fed manufacturing index, January (GS 14.4, consensus 19.8, last 15.4): We estimate that the Philadelphia Fed manufacturing index declined by 1.0 to 14.4 in January, reflecting a drag from Omicron and a potential further pullback in auto production.

- 08:30 AM Initial jobless claims, week ended January 15 (GS 240k, consensus 220k, last 230k); Continuing jobless claims, week ended January 8 (consensus 1,521k, last 1,559k); We estimate initial jobless claims increased to 240k in the week ended January 15.

- 10:00 AM Existing home sales, December (GS flat, consensus -0.8%, last +1.9%): We estimate that existing home sales were flat in December, following a 1.9% increase in November.

Friday, January 21

- There are no major economic data releases scheduled.

Source: Deutsche Bank, BofA, Goldman