April 11, 2022 – 06:52 AM…

After a rather quiet start to the month of April, DB’s Henry Rallen notes that it is an eventful calendar for markets this week ahead of Easter, with Thursday’s ECB meeting set to be one of the main highlights. At their last meeting in March, the ECB adopted a more hawkish position than had been expected by confirming a faster reduction in their asset purchases. That’s set to see APP purchases fall from €40bn in April to €30bn in May and then €20bn in June, with the possibility of ending purchases altogether in Q3. Since then however, inflation has accelerated by even more than the consensus expected, with the flash CPI estimate for the Euro Area at +7.5% in March, which is the highest since the formation of the single currency, and up from +5.9% in February.

In terms of what to look for this time round, Deutsche Bank economists write in their preview that they’re not expecting much change to the ECB’s message. Instead, they think that when the new staff forecasts are available in June, they’ll announce that APP purchases will end in July, ahead of a liftoff in the policy rate in September, so an underlying direction of travel that’s becoming clear. Their view is that the risks are tiled towards a more hawkish, rather than a less hawkish tone though; furthermore, the bank’s economists changed their call last week to expect a more aggressive ECB exit given the deteriorating inflation outlook, and now see the terminal rate reaching 2% by end-2023, which is 250bps higher than at present.

Staying on that central bank theme, another big highlight this week will be the release of the US CPI data for March on Tuesday, which is the last one the Fed will get ahead of their meeting in early April. That comes amidst heightened speculation that the Fed could move by 50bps at the next meeting, and futures are pricing in an 88% chance of a 50bps move.

Speaking of the actual print, DB’s economists are expecting that the monthly gain in headline CPI of +1.3% will push the year-on-year rate up to +8.6%, which hasn’t been seen since 1981. That said, they think that March is likely to be the peak in the year-on-year rates for both headline and core, since the base effects from last year’s surge in used car prices will begin rolling off in the April data.

Finally, and also this week, we’ll start to see the Q1 earnings season get going, with releases from a number of US financials, among others. They include JPMorgan Chase and BlackRock (both on Wednesday), ahead of reports from Citigroup, Morgan Stanley, Goldman Sachs and Wells Fargo (on Thursday). But overall, it’s still a fairly quiet on the earnings front with just 15 companies in the S&P 500 reporting, and it’ll only really ramp up the following week with 68 of the index reporting, and then 181 in the week after that. While some strategists point to continued solid sequential earnings growth in Q1, and look for slightly above average beats, skeptics have emerged who warn that Q1 may be as good as it gets for growth (more in our preview to follow shortly).

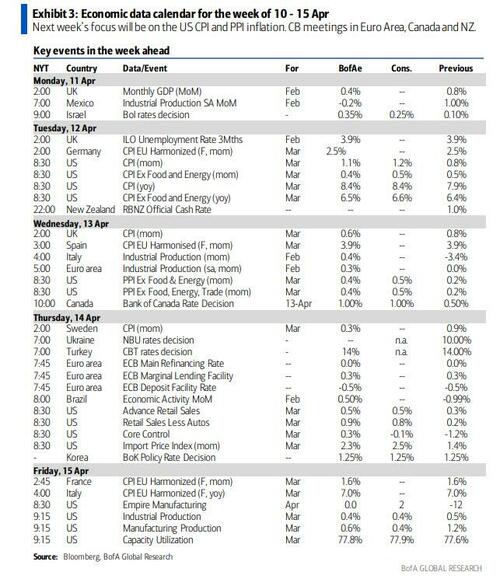

Here is a day-by-day calendar of events

Monday April 11

- Data: China March CPI and PPI, Japan March machine tool orders, UK February monthly GDP, industrial, manufacturing production, index of services, trade balance, construction output

- Central banks: Fed’s Bostic, Waller, Bowman and Evans speak, BoJ’s Governor Kuroda speaks

- Other: EU foreign ministers meet

Tuesday April 12

- Data: US March CPI, monthly budget statement, NFIB small business optimism, Japan March PPI, bank lending, UK March jobless claims change, February unemployment rate, weekly earnings, France February trade balance, Germany and Eurozone April ZEW survey

- Central banks: Fed’s Brainard and Barkin speak

- Earnings: Saudi Aramco, Asos

Wednesday April 13

- Data: US March PPI, China March trade balance, Japan March money stock, February core machine orders, UK March CPI, RPI, February house price index, Italy February industrial production

- Central banks: BoC rate decision

- Earnings: JPMorgan, BlackRock, Delta Air Lines, Tesco

Thursday April 14

- Data: US April University of Michigan sentiment, March retail sales, import and export price indices, February business inventories, initial jobless claims, Canada February manufacturing sales, wholesale trade sales

- Central banks: ECB rate decision, Fed’s Mester and Harker speak

- Earnings: TSMC, Wells Fargo, Morgan Stanley, Goldman Sachs, Citi, UnitedHealth, Coinbase, Ericsson

Friday April 15

- Data: US April Empire manufacturing index, March industrial production, capacity utilisation, China March new home prices

- Central banks: ECB Survey of Professional Forecasters

* * *

Looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales report on Thursday. There are several speaking engagements from Fed officials this week, including remarks by Governor Brainard on Tuesday at an event hosted by the Wall Street Journal.

Monday, April 11

There are no major economic data releases scheduled.

- 09:30 AM Atlanta Fed President Bostic (FOMC non-voter) and Fed Governors Bowman (FOMC voter) and Waller (FOMC voter) speak: Atlanta Fed President Raphael Bostic and Fed Governors Michelle Bowman and Christopher Waller will deliver remarks at a Fed Listens event in Nashville. On Thursday, President Bostic noted that the Fed should “move [its] policy closer to a neutral position,” but cautioned that “we need to do it in a measured way.” Last week, President Bostic said that his submission to the FOMC’s March Summary of Economic Projections included “six rate hikes for 2022 and two more for 2023.” He noted that “the elevated levels of uncertainty are front forward in my mind and have tempered my confidence that an extremely aggressive path is appropriate today.” Earlier this week, the March FOMC minutes noted that while “many” participants would have favored a 50bp hike in March, “a number” of those participants judged a 25bp hike to be more appropriate given the uncertainty related to the Russian invasion of Ukraine. We expect the FOMC to hike by 50bp at its May and June meetings. In her last public appearance, on February 21st, Governor Bowman noted that she favored taking “forceful action to help reduce inflation, bringing it back toward our 2% goal, while keeping the economy on track.” On March 18th, Governor Waller said that “the data is basically screaming at us to go [with] 50 [basis-point hikes] but the geopolitical events were telling you to go forward with caution.” Later, on March 24th, Governor Waller noted that “at a later date, certainly not anytime soon, the FOMC may start to consider sales of [mortgage-backed securities].” The March minutes have since revealed that FOMC participants will likely support peak runoff caps of $60bn per month for Treasury securities and $35bn for mortgage-backed securities—for a total of $95bn per month and roughly double the pace of last cycle’s runoff. Participants also “generally agreed” that “the caps could be phased in over a period of three months or modestly longer” and that it would be appropriate to consider sales of MBS “after balance sheet runoff was well under way.” We continue to expect the FOMC to announce the start of balance-sheet normalization at its May meeting.

- 12:40 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss the economy and monetary policy at the Detroit Economic Club. Audience and media Q&A are expected. On Friday, President Evans noted that he was “optimistic that we can get to neutral, look around, and find that we’re not necessarily that far from where we need to go.” On March 24th, President Evans noted that he “would be comfortable with … each meeting increasing [the federal funds rate] by a quarter-point,” but that “maybe a 50 [basis-point hike] helps.”

Tuesday, April 12

- 06:00 AM NFIB small business optimism, March (consensus 95.0, last 95.7)

- 08:30 AM CPI (mom), March (GS +1.32%, consensus +1.2%, last +0.8%); Core CPI (mom), March (GS +0.47%, consensus +0.5%, last +0.5%)

- CPI (yoy), March (GS +8.60%, consensus +8.4%, last +7.9%); Core CPI (yoy), March (GS +6.59%, consensus +6.6%, last +6.4%): We estimate a 0.47% increase in March core CPI (mom sa), which would boost the year-on-year rate by 0.2pp to 6.6%. Our forecast reflects a decline in used car prices from elevated levels, but Ukraine-related increases for new cars and auto parts. We also expect a post-Omicron increase in hotel lodging and airline prices, as well as additional wage-price pass-through in services categories like recreation and household operations. We estimate rent increased by 0.58% and OER increased by 0.43%, reflecting a boost to the former from rebounding downtown rents and a drag on the latter from imputed utilities. We also assume another month of strength for health and car insurance rates, with the latter boosted by a rebound in accidents and higher vehicle replacement costs. We estimate a 1.32% monthly increase in headline CPI, reflecting a sharp rise in energy prices as well as higher grocery and restaurant prices.

- 12:10 PM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Lael Brainard will discuss the economic outlook during an event hosted by the Wall Street Journal. Moderated Q&A is expected. On Tuesday, Governor Brainard stressed that “currently, inflation is much too high and is subject to upside risks,” and noted that the Fed is “prepared to take stronger action if indicators of inflation and inflation expectations indicate that such action is warranted.”

- 06:45 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will speak at an event hosted by the Money Marketeers of New York University. Text and audience and media Q&A are expected. On Wednesday, President Barkin noted that the Fed has “moved at a 50 basis-point clip in the past, [and] could [do so] again.” Last week, President Barkin said that “there is a real chance” that the Fed would need to take the federal funds rate above its estimated neutral level in order to bring down inflation.

Wednesday, April 13

- PPI ex-food and energy, March (GS +0.6%, consensus +0.5%, last +0.2%); PPI ex-food, energy, and trade, March (GS +0.6%, consensus +0.5%, last +0.2%): We estimate a 0.6% increase for PPI ex-food and energy and PPI ex-food and energy, and trade, reflecting a continued boost from supply chain bottlenecks, labor shortages, and commodity prices. We estimate that headline PPI increased by 1.2% in March.

- Thursday, April 14

- 08:30 AM Retail sales, March (GS flat, consensus +0.6%, last +0.3%); Retail sales ex-auto, March (GS +1.0%, consensus +0.8%, last +0.2%); Retail sales ex-auto & gas, March (GS flat, consensus +0.2%, last -0.4%); Core retail sales, March (GS -0.3%, consensus flat, last -1.2%): We estimate a 0.3% decline in March core retail sales (ex-autos, gasoline, and building materials; mom sa). The elevated level of retail sales suggest a high seasonal hurdle for additional gains during the busy spring shopping season, and we believe higher gasoline prices and the phasing-out of the child tax credit are weighing on discretionary spending among lower-income consumers. On the positive side, we expect a further rise in restaurant spending as public health normalized, and we expect a boost in the general merchandise category from higher nominal fuel sales. We estimate a flat reading for headline retail sales, reflecting lower auto sales but a spike in gasoline prices.

- 08:30 AM Import price index, March (consensus +2.3%, last +1.4%): Export price index, March (consensus +2.2%, last +3.0%)

- 08:30 AM Initial jobless claims, week ended April 9 (GS 166k, consensus 175k, last 166k); Continuing jobless claims, week ended April 2 (consensus 1,500k, last 1,523k): We estimate initial jobless claims were unchanged at 166k in the week ended April 9.

- 10:00 AM University of Michigan consumer sentiment, April preliminary (GS 60.0, consensus 59.0, last 59.4): We expect the University of Michigan consumer sentiment index increased by 0.6pt to 60.0 in the preliminary April reading, reflecting somewhat strong signals from other consumer confidence measures.

- 03:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak at the Ohio Economic Forum, hosted by the University of Akron. Text and audience Q&A are expected. In her latest public appearance, on March 23rd, President Mester noted that the Fed is “going to need to do some 50 basis-point moves,” and argued that the Fed should “be more aggressive earlier rather than later.”

- 06:00 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will give a speech on the economy and the labor market at Rider University in New Jersey. Text and audience Q&A are expected. On Wednesday, President Harker cautioned that the Fed should act “in a way that isn’t so aggressive that we risk putting the economy in recession,” while noting that “the good news is that … [the economy is] very healthy.”

Friday, April 15

- US equity and bond markets will be closed in observance of Good Friday.

- 08:30 AM Empire State manufacturing survey, April (consensus +1.0, last -11.8)

- 09:15 AM Industrial production, March (GS +0.7%, consensus +0.4%, last +0.5%); Manufacturing production, March (GS +0.6%, consensus +0.5%, last +1.2%); Capacity utilization, March (GS 78.0%, consensus 77.8%, last 77.6%): We estimate industrial production rose by 0.8% in March, with strong auto production offsetting weaker natural gas. We estimate capacity utilization increased by 0.4pp to 78.0%.

Source: DB, BofA, Goldman