Monday April 25, 2022…

It’s a busy week with over a hundred companies reporting, and a barrage of economic data on deck. According to DB’s Jim Reid, the week is also important for European inflation with German CPI on Thursday and the French and Italian equivalent (plus PPI) on Friday with the overall Euro CPI the same day. US (Thursday) and European Q1 GDP (Friday) will also be of interest. Unlike last week, when a relentless barrage of chattering central bank uberhawks sent stocks spiraling lower, we are now in the Fed blackout period ahead of the FOMC’s meeting in the first week of May, so they won’t add to the hawkishness for the 9.5 days before we get the FOMC decision. Note that the BoJ meet on Thursday although nothing suggests they are going to pivot and will remain the last hawkish shoe to drop.

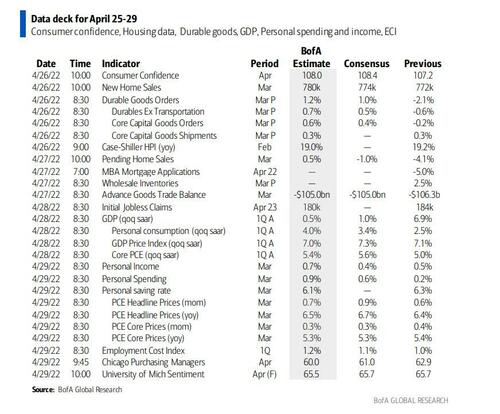

Back to the US where inflation-related data will be the closest watched with Friday’s ECI expected to be strong. This is one of the key indicators the Fed use for labor market strength. The core PCE deflator (the Fed’s preferred inflation measure) also comes out as part of the income and spending report data on Friday. The rate of growth may well tick down here so this might provide a shred of good news on inflation without changing the story too much.

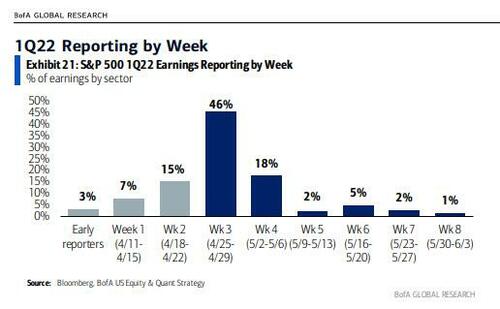

It is also a crucial week for corporate earnings with 179 of the S&P 500 reporting and 134 in the Stoxx 600. Big US tech will be the highlight with Microsoft and Alphabet (tomorrow), Meta (Wednesday), and Apple and Amazon (Thursday). Some context here: the Nasdaq 100 Index has erased about $1 trillion in market value since Netflix released disappointing earnings and is closing in on oversold levels; the tech-heavy FANGMAN basket has lost $2.4 trillion in market cap from 2021 ATH as Netflix and Facebook Meta, have lost most of their gains from past 5yrs. Remember when Facebook hit the $1tn market cap club in 2021? Now it’s worth exactly half that.

Meanwhile, consumption patterns will be in focus when we get results from Coca-Cola (today), Mondelez, Chipotle (tomorrow), Kraft Heinz (Wednesday) and McDonald’s (Thursday). Meanwhile, a range of banks across the globe will give a pulse check on consumer credit. Notable reporters will include HSBC, UBS, Santander (tomorrow), Credit Suisse (Wednesday), Barclays (Thursday), finishing with BBVA and NatWest on Friday. Other notable financials reporting will include Visa (tomorrow), PayPal (Wednesday) and Mastercard (Thursday).

Other tech-related companies releasing results will include Activision Blizzard (Monday), LG, Qualcomm, Spotify (Wednesday), Samsung, Intel and Twitter (Thursday). In healthcare, another sector that benefitted from the pandemic, reporters will include Novartis (tomorrow), GlaxoSmithKline (Wednesday), Eli Lilly, Merck, Sanofi (Thursday) and AstraZeneca (Friday).

To see how the commodity rally and the focus on energy transition affected major commodity companies worldwide, markets will get earnings from Iberdrola, Vale (Wednesday), Total, Repsol (Thursday), Exxon, Orsted, Chevron and Eni (Friday). Downstream users like transport firms will report too, including General Motors (tomorrow), Boeing, Mercedes-Benz and Ford (Wednesday). Other notable corporates releasing results will include Texas Instruments, General Electric, UPS and Caterpillar.

The rest of the day by day calendar of events is shown below.

Day-by-day calendar of events

Monday April 25

- Data: US April Dallas Fed Manufacturing activity, March Chicago Fed national activity index, Japan March services PPI, Germany April

- IFO business climate, Eurozone February construction output

- Earnings: Coca-Cola, Activision Blizzard, Vivendi

Tuesday April 26

- Data: US April Conference Board consumer confidence, Richmond Fed manufacturing index, March durable goods orders, new home sales, February FHFA house price index, Japan March jobless rate, UK March public finances

- Central banks: ECB’s Villeroy speaks

- Earnings: Microsoft, Alphabet, Atlas Copco, Visa, PepsiCo, Novartis, UPS, Texas Instruments, Raytheon Technologies, Ganfeng Lithium, HSBC, General Electric, Mondelez, 3M, UBS, General Motors, Capital One, Warner Bros Discovery, Santander, ADM, Valero, Chipotle, MSCI

Wednesday April 27

- Data: US March wholesale inventories, pending home sales, China March industrial profits, Germany May GfK consumer confidence, France April consumer confidence

- Earnings: LG, Meta, Vale, T-Mobile, Qualcomm, Amgen, Yara, Boeing, PayPal, Canadian Pacific, GlaxoSmithKline, Mercedes-Benz, Iberdrola, Ford, Kraft Heinz, Hess, Lloyds, Spotify, UniCredit, Credit Suisse, Hertz

Thursday April 28

- Data: US Q1 GDP, personal consumption, core PCE, initial jobless claims, April Kansas City Fed manufacturing activity, Japan March retail sales, industrial production, housing starts, Germany April CPI, Italy April consumer, manufacturing confidence, economic sentiment, March hourly wages, February industrial sales, Eurozone April economic confidence

- Central banks: BoJ decision, ECB’s Economic Bulletin, ECB’s Wunsch speaks

- Earnings: Samsung, Apple, Amazon, Mastercard, Eli Lilly, Thermo Fisher Scientific, Merck, Comcast, Intel, McDonald’s, Swedbank, Linde, Sanofi, Caterpillar, TotalEnergies, Gilead Sciences, Twitter, Nordic Semiconductor, PG&E, Southwest Airlines, Nokia, Barclays, Repsol, Carlyle, Zendesk, Roku

Friday April 29

- Data: US Q1 employment cost index, March personal income and spending, PCE deflator, April MNI Chicago PMI, France April CPI, March consumer spending, PPI, Q1 GDP, Italy Q1 GDP, April CPI, March PPI, Germany Q1 GDP, March import price index, Eurozone Q1 GDP, April CPI, March M3, Canada February GDP

- Earnings: Bank of China, Exxon Mobil, Orsted, Chevron, AbbVie, Bristol-Myers Squibb, AstraZeneca, Honeywell, DBS, Colgate-Palmolive, Eni, Neste Oyj, BBVA, NIO, CaixaBank, NatWest

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Tuesday, the Q1 GDP advance release on Thursday, and the employment cost index and core PCE reports on Friday. There are no speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, April 25

- 10:30 AM Dallas Fed manufacturing index, April (consensus 4.5, last 8.7)

Tuesday, April 26

- 08:30 AM Durable goods orders, March preliminary (GS +0.7%, consensus +1.0%, last -2.1%); Durable goods orders ex-transportation, March preliminary (GS +0.7%, consensus +0.6%, last -0.6%); Core capital goods orders, March preliminary (GS +0.7%, consensus +0.4%, last -0.2%); Core capital goods shipments, March preliminary (GS +0.7%, consensus +0.5%, last +0.3%): We estimate that durable goods orders increased 0.7% in the preliminary March report, following a 2.1% decline in February.

- 09:00 AM FHFA house price index, February (consensus +1.5%, last +1.6%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, February (GS +1.6%, consensus +1.50%, last +1.79%); We estimate that the S&P/Case-Shiller 20-city home price index rose by 1.6% in February, following a 1.79% (19.1% yoy) increase in January.

- 10:00 AM Conference Board consumer confidence, April (GS 107.2, consensus 108.5, last 107.2); We estimate that the Conference Board consumer confidence index was flat at 107.2 in April, reflecting weaker signals from other confidence measures.

- 10:00 AM New home sales, March (GS -1.0%, consensus +1.3%, last -2.0%): We estimate that new home sales declined 1.0% in March, following a 2.0% decline in February.

- 10:00 AM Richmond Fed manufacturing index, April (consensus 8, last 13)

Wednesday, April 27

- 08:30 AM Advance goods trade balance, March (GS -$110.0bn, consensus -$105.0bn, last -$106.3bn); We estimate that the goods trade deficit increased by $3.7bn to $110.0bn in March compared to the final February report, reflecting an increase in imports.

- 08:30 AM Wholesale inventories, March preliminary (consensus +1.5%, last +2.5%): Retail inventories, March (consensus +1.6%, last +1.1%)

- 10:00 AM Pending home sales, March (GS -2.0%, consensus -1.0%, last -4.1%): We estimate that pending home sales decreased by 2.0% in March, following a 4.1% decrease in February.

Thursday, April 28

- 08:30 AM Initial jobless claims, week ended April 23 (GS 185k, consensus 180k, last 184k); Continuing jobless claims, week ended April 16 (consensus 1,393k, last 1,417k): We estimate that initial jobless claims edged up to 185k in the week ended April 23.

- 08:30 AM GDP, Q1 advance (GS +1.5%, consensus, +1.0%, last +6.9%); Personal consumption, Q1 advance (GS +3.6%, consensus +3.4%, last +2.5%): We estimate that GDP growth slowed to +1½% annualized in the advance reading for Q1, following a 6.9% annualized increase in Q4. Our forecast reflects firming consumption growth (to +3.6%) and strong growth in business structures and equipment investment, offset by a drag from net exports (-2.1pp). We also expect a negative contribution from slower inventory growth (-0.8pp), following a strong positive contribution in Q4 (+5.1pp).

- 11:00 AM Kansas City Fed manufacturing index, April (consensus +35, last +37)

Friday, April 29

- 08:30 AM Employment cost index, Q1 (GS +1.3%, consensus +1.1%, prior +1.0%): We estimate that the employment cost index rose 1.3% in Q1 (qoq sa), which would boost the year-on-year rate by five tenths to +4.5%. Our forecast reflects larger-than-normal annual raises due to labor shortages and the elevated quits rate. Relatedly, the share of workers with unchanged wages fell to a 15-year low in the quarter (11%, yoy basis, Atlanta Fed wage tracker). Incentive-paid industries also weighed on the Q4 ECI reading, whereas we expect a flat or positive contribution in Q1.

- 08:30 AM Personal income, March (GS +0.5%, consensus +0.4%, last +0.5%); Personal spending, March (GS +0.7%, consensus +0.6%, last +0.2%); PCE price index, March (GS +0.83%, consensus +0.9%, last +0.58%); PCE price index (yoy), March (GS +6.63%, consensus +6.7%, last +6.35%); Core PCE price index, March (GS +0.25%, consensus +0.3%, last +0.35%); Core PCE price index (yoy), March (GS +5.22%, consensus +5.3%, last +5.40%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.25% month-over-month in March, corresponding to a 5.22% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.83% in March, corresponding to a 6.63% increase from a year earlier. We expect that personal income increased by 0.5% and personal spending increased by 0.7% in March.

- 09:45 AM Chicago PMI, April (GS 62.9, consensus 62.0, last 62.9): We estimate that the Chicago PMI was unchanged in April at 62.9.

- 10:00 AM University of Michigan consumer sentiment, April final (GS 65.0, consensus 65.7, last 65.7): We expect the University of Michigan consumer sentiment index decreased by 0.7pt to 65.0 in the final April reading.

Source: DB, BofA, Goldman