BY TYLER DURDEN …

MONDAY, OCT 03, 2022 – 08:00 AM …

Welcome to the first business day of October...

As DB’s Jim Reid writes, it was one of the weaker – if not the weakest in terms of breadth – third quarters and Septembers in most of our careers. Some highlights: in September just 2 non-currency assets out of the 38 Deutsche normally track managed to post a positive return on the month. In Q3 it was just one which is the worst since the bank started tracking all these assets in its monthly review back in 2007. Previously, the worse quarters saw 5 decliners (in Q2 this year and Q2 2020). So this remains an “everything down” market which given that (pretty much) everything went up for 40 years together to extreme valuations shouldn’t be a huge surprise now that the drivers have changed.

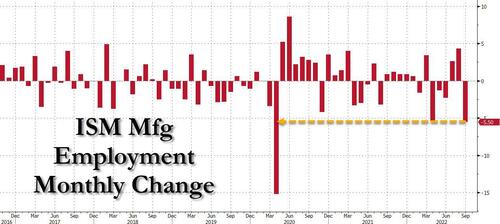

Anyway, going back to the calendar, the highlight in the first week of the final quarter of 2022 will be payrolls on Friday. This may be a big disappointment following today’s Mfg ISM employment index which unexpectedly plunged by the most since the covid crash and the second biggest drop this decade.

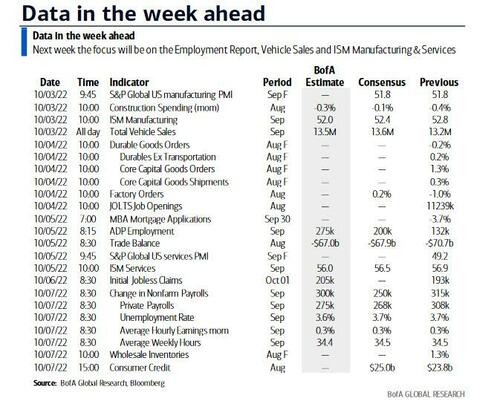

We’ll also see the US ISMs and various PMIs from around the world.

Exploring the main highlights in more detail let’s start with payrolls. Economist consensus expects nonfarm payrolls to have added +250k, versus +315k in August, with the unemployment rate at 3.7%, unchanged from the past month. Staying with employment the JOLTS data will be out tomorrow. Most economists prefer it to payrolls as a guide to how tight labor markets are but it’s unfortunately a month lagging. ADP on Wednesday will also be interesting.

Today will see the manufacturing US PMI with services on Wednesday. The print was a major disappointment, coming in at just 50.9, below the 52.1 expected, and down from 52.8, and sparking a furious risk rally amid expectations this could be bad enough for the Fed to slow the pace of tightening.

This morning there was plenty of European manufacturing PMIs to watch out for, and talking of Europe, DB’s economists lifted their baseline call on the ECB terminal rate by 50bp to 3% on Friday. Earlier last week, they had identified the fiscal stance as a key upside risk to their ECB call and the larger-than-expected German fiscal package was the materialization of this risk. There are lots of moving parts at the moment and our German economists think this package will upgrade their 2023 growth forecast (from -3.5% to around -2%) and reduce their inflation forecast.

On Friday night, S&P placed the AA rating on negative outlook which shouldn’t mean much in the short term but adds another straw on that camel’s back. Perhaps in response, this morning British Prime Minister Truss delayed the cutting the 45% additional rate of tax, due to the fact that many government MPs were likely to vote against the measure.

Elsewhere, we have an OPEC+ decision on output when the cartel meet on Wednesday to address oil market weakness as Brent crude hovers around $90 per barrel, a level seen before the Ukraine crisis and down from the above-$120 peak this year. This will be the first in person OPEC+ meeting since covid, and according to media reports, OPEC+ will cut oil output by 1mmb/d or more, news which sent oil sharply higher in early trading.

Lastly, over in Asia, the highlight is likely to be September’s Tokyo CPI numbers tomorrow. The rest of the day-by-day calendar of events is at the end as usual which includes some of the central bank speak which is again plentiful.

Courtesy of DB, here is a day-by-day calendar of events

Monday October 3

- Data: US September ISM manufacturing index, total vehicle sales, August construction spending, Japan September vehicle sales, 3Q Tankan large and small manufacturing index, France August budget balance, Italy and Canada September manufacturing PMI, Italy September new car registrations, budget balance

- Central banks: BoJ summary of opinions, Fed’s Bostic and Williams speak

Tuesday October 4

- Data: US August JOLTS report, factory orders, Japan September Tokyo CPI, monetary base, Eurozone August PPI

- Central banks: Fed’s Logan, Williams, Mester, Jefferson and Daly speak, ECB’s Centeno speaks

Wednesday October 5

- Data: US September ADP report, ISM services index, August trade balance, UK September new car registrations, official reserves changes, Germany August trade balance, Italy September services PMI, Q2 deficit to GDP, France August industrial and manufacturing production, Canada August building permits, international merchandise trade

- Central banks: Fed’s Bostic speaks

- Earnings: Tesco

- Other: OPEC+ meeting

Thursday October 6

- Data: US initial jobless claims, Germany September construction PMI, August factory orders, UK September construction PMI, Eurozone August retail sales

- Central banks: ECB’s account of the September meeting, Fed’s Evans, Cook, Waller and Mester speak, BoJ’s Kuroda speaks

- Earnings: Constellation Brands

Friday October 7

- Data: US September change in nonfarm payrolls, unemployment rate, average hourly earnings, labor force participation rate, August wholesale trade sales, consumer credit, China September foreign reserves, Japan August household spending, labor cash earnings, leading and coincident index, Italy August retail sales, Germany August import price index, retail sales, industrial production, France August trade balance, Canada September unemployment rate, participation rate

- Central banks: Fed’s Williams speaks

* * *

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the ISM report on Monday, the JOLTS job openings report on Tuesday, and the employment situation report on Friday. There are several speaking engagements from Fed officials this week.

Monday, October 3

- 09:05 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will deliver opening remarks at a conference on technology hosted by the Atlanta Fed. On September 28th, President Bostic noted that “the lack of progress [on inflation] thus far has me thinking much more now that we have to get to a moderately restrictive stance … and for me, that is in the 4.25% to 4.5% range for our policy,” which is in line with the end-2022 median dot in the FOMC’s September Summary of Economic Projections.

- 09:45 AM S&P Global US manufacturing PMI, September final (consensus 51.8, last 51.8)

- 10:00 AM ISM manufacturing index, September (GS 51.8, consensus 52.1, last 52.8): We estimate that the ISM manufacturing index declined by 1pt to 51.8 in September, reflecting weak industrial trends abroad and convergence towards other manufacturing surveys (GS manufacturing survey tracker +0.4pt to 50.4).

- 10:00 AM Construction spending, August (GS -0.6%, consensus -0.3%, last -0.4%): We estimate construction spending decreased 0.6% in August.

- 03:10 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at the US Hispanic Chamber of Commerce’s annual conference in Phoenix, Arizona. Text and media Q&A are expected. On August 30th, President Williams noted that the Fed needs “to get not just to neutral in a real interest rate sense, but you’re actually trying to get … demand in line with supply.” President Williams also noted that the economy was “coming into … the second half of the year … still with some positive momentum,” and emphasized that “the labor market is very strong.”

- 05:00 PM Lightweight motor vehicle sales, September (GS 13.4mn, consensus 13.55mn, last 13.18mn)

Tuesday, October 4

- 09:00 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver opening remarks at the Atlanta Fed’s technology conference. On September 26th, President Logan noted that while she recognizes that the FOMC’s policy actions “will have serious implications for the labor market, … restoring price stability is foundational to a stronger labor market over time.”

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver opening and closing remarks at an event on culture in the workplace hosted by the New York Fed.

- 09:15 AM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak at a conference on payments systems hosted by the Chicago Fed. Text and audience Q&A are expected. On September 29th, when asked if a recession would lead the Fed to hesitate to increase the federal funds rate even if inflation remained high, President Mester emphasized that the Fed has “got to get to price stability. So we’re going to do what we have to do to get the price stability. So—no.” President Mester also noted that her growth forecast is “quite low,” stressing that “real growth will be well under trend,” and that “that’s going to feel bad,” but that the FOMC’s first responsibility is to restore price stability.

- 10:00 AM Factory orders, August (GS flat, consensus +0.2%, last -1.0%); Durable goods orders, August final (consensus -0.2%, last -0.2%); Durable goods orders ex-transportation, August final (consensus +0.2%, last +0.2%); Core capital goods orders, August final (last +1.3%); Core capital goods shipments, August final (last +0.3%): We estimate that factory orders were unchanged in August following a 1.0% decrease in July. Durable goods orders decreased 0.2% in the August advance report and core capital goods orders increased 1.3%.

- 10:00 AM JOLTS job openings, August (GS 11,000k, consensus 11,075k, last 11,239k)

- 11:45 AM Fed Governor Jefferson speaks: Fed Governor Philip Jefferson will deliver a speech on the impact of technology on the post-pandemic economy at the Atlanta Fed’s technology conference. Text and moderated Q&A are expected.

- 01:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated Q&A at the Council on Foreign Relations in New York. On September 30th, President Daly stressed that the Fed’s “number one priority is to get inflation down,” and that she believes doing so “will take additional rate hikes.” Earlier, on August 18th, President Daly argued the Fed was “facing a global economy that is growing slower, … [that] that will push back on US growth,” and that the FOMC needed “to take that into consideration.”

Wednesday, October 5

- 08:15 AM ADP employment report, September (GS +150k, consensus +200k, last +132k): We expect a 150k rise in ADP payroll employment in September, reflecting low layoffs rates but constrained hiring from tight labor markets.

- 08:30 AM Trade balance, August (GS -$66.0bn, consensus -$67.9bn, last -$70.7bn): We estimate that the trade deficit narrowed by $4.7bn to $66.0bn in August, reflecting a decrease in imports in the advanced goods report.

- 09:45 AM S&P Global US services PMI, September final (consensus 49.2, last 49.2)

- 10:00 AM ISM services index, September (GS 55.9, consensus 56.0, last 56.9)We estimate that the ISM services index declined by 1pt to 55.9 in September, reflecting convergence towards other business surveys and the volatility in financial markets. Our non-manufacturing survey tracker rose by 1.7pt to 53.1.

- 04:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will take part in a discussion on inflation during a virtual event hosted by Northwestern University. Text and audience Q&A are expected.

Thursday, October 6

- 08:30 AM Initial jobless claims, week ended October 1 (GS 205k, consensus 205k, last 193k): Continuing jobless claims, week ended September 24 (consensus 1,380k, last 1,347k): We estimate initial jobless claims increased to 205k in the week ended October 1.

- 01:00 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss the economy and monetary policy at a moderated Q&A hosted by the Illinois Chamber of Commerce in Chicago. On September 28th, President Evans noted that the federal funds rate “is beginning to move into restrictive territory,” but that “with inflation as high as it is, and getting inflation under control being job one, it’s not nearly restrictive enough.” President Evans stressed that “the risks continue to be high” that there will be “more persistent inflation,” and noted that while the Fed needs to be “mindful” of any potential deterioration in the labor market, it would still “need to [see] quite a substantial amount of indication of that before [it would] seriously weight that against the very high inflation that we’re facing now.”

- 01:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver a speech on the economic outlook at the Peterson Institute for International Economics in Washington. Text and moderated Q&A are expected. This will be Lisa Cook’s first speech as Fed Governor.

- 05:00 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will discuss the economic outlook at the University of Kentucky in Lexington, Kentucky. Text and moderated Q&A are expected. On September 9th, Governor Waller noted that “if the unemployment rate were to stay under 5%,” the FOMC “could be really aggressive on inflation,” but that “once it gets over 5%, there are going to be obvious pressures to start making tradeoffs.” Governor Waller also noted that he expects “strong household savings, the tight labor market, and additional availability of manufactured goods … will support a slowing, rather than a contraction, in demand.”

- 06:30 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook during an event hosted by the Council for Economic Education. Audience Q&A is expected.

Friday, October 7

- 08:30 AM Nonfarm payroll employment, September (GS +200k, consensus +250k, last +315k); Private payroll employment, September (GS +200k, consensus +300k, last +308k); Average hourly earnings (mom), September (GS +0.35%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), September (GS +5.0%, consensus +5.1%, last +5.2%); Unemployment rate, September (GS 3.7%, consensus 3.7%, last 3.7%); Labor force participation rate, September (GS 62.4%, consensus 62.4%, last 62.4%): We estimate nonfarm payrolls rose by 200k in September (mom sa), a slowdown from the +315k pace in August reflecting the loss of the summer youth labor force. Big Data indicators were mixed in the month, but jobless claims remain low and the level of labor demand also remains elevated despite declining meaningfully this year. We estimate the unemployment rate was unchanged at 3.7% in September, reflecting flat-to-up labor force participation and a rise in household employment. We estimate a 0.35% increase in average hourly earnings (mom sa), reflecting neutral calendar effects but a possible boost from autumn recruitment efforts.

- 10:00 AM Wholesale inventories, August final (consensus +1.3%, last +1.3%)

- 10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a moderated Q&A at an event in Buffalo, New York.

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss wealth inequality at an event hosted by Goodwill of North Georgia in Atlanta. Audience Q&A is expected.

Source: DB, Goldman. BofA