BY TYLER DURDEN …

MONDAY, OCT 10, 2022 – 06:29 AM …

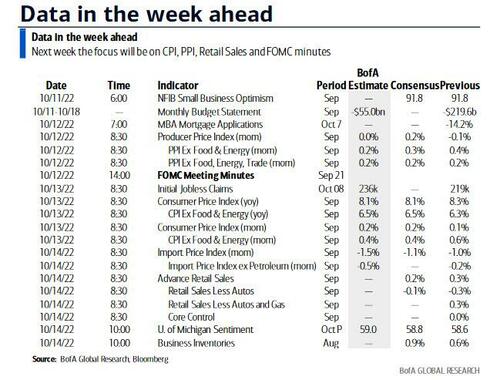

After another extremely volatile week which ended on a payrolls high, or rather low for stocks, we get a quieter week for data with what Jim Reid calls “one ginormous exception” – yes all roads to and from will all center around US CPI on Thursday.

As the DB strategist notes, over the last few months Fed expectations have generally risen with this number and markets have consistently sold off. However there have been a few strong counter-trend rallies on either the perception of a coming Fed pivot or on hopes of being near peak inflation. All have so far been ultimately reversed but the potential for Thursday to dominate the next few weeks of trading is high. Before we delve into some of the details, US PPI and the FOMC minutes (Wednesday), and the UoM inflation expectations and US retail sales (Friday) are the other key events Stateside. It’s Columbus Day in the US today with bond markets shut but equities open. It should be quiet but Fed VC Brainard is speaking later today to keep us on our toes. Finally in the US, results from key banks will kick off the earnings season later in the week before the deluge over the subsequent 2-3 weeks.

Elsewhere across the globe, we will also get inflation and trade data from China (Friday) and the PPI for Japan (Thursday). In Europe, the UK will be in the spotlight with an array of economic indicators due, including labor market data (tomorrow) and monthly GDP (Wednesday). After the dramatic aftermath of the UK mini-budget, there will also be some focus on Italy’s draft budget that is supposed to be submitted to the EC by Saturday. Clearly any signs of it being too expansionary could be a red rag to markets increasingly concerned about debt sustainability in pockets of the DM world with yields this high.

A quick early preview of the US CPI number now. Our economists highlight that with gas prices down another near 7% from August to September, energy will again drag on the headline CPI print (+0.28% forecast vs. +0.12% previously). However, core CPI (+0.44% vs. +0.57%) will draw the most focus especially given last month’s upside surprise. Assuming their forecasts are correct, year-over-year headline CPI should continue to decline, falling two-tenths to 8.1%, while core should tick up two-tenth to peak at 6.5%. This is in line with consensus. Whether one number should be the basis for huge swings in markets, it seems inevitable that a notable miss on core on either side could bring about big moves in trading over the coming weeks so stand by.

As mentioned at the top, US Q3 earnings season will kick off with results from major US banks on Friday, including JPMorgan, Citi and Morgan Stanley. Consumer-focused companies like PepsiCo (Thursday), Domino’s Pizza and Delta (both Friday) will also be in focus. TSMC reports on Thursday amid concerns of oversupply in some pockets of the semiconductor industry. The full day by day week ahead is at the end as usual.

Courtesy of DB, here is a day-by-day calendar of events

Monday October 10

- Central banks: Fed’s Evans and Brainard speak, ECB’s Centeno and Lane speak

- Other: Annual meetings of the IMF and World Bank (until October 16)

Tuesday October 11

- Data: US September NFIB small business optimism, UK September payrolled employees monthly change, jobless claims change, August average weekly earnings, employment change, Japan September Economy Watchers Survey, August trade balance BoP basis, Italy August industrial production

- Central banks: Fed’s Mester speaks, ECB’s Lane and Villeroy speak, BoE’s Bailey and Cunliffe speak

- Other: IMF’s World Economic Outlook and Global Financial Stability Report released

Wednesday October 12

- Data: US September PPI, Japan September machine tool orders, August core machine orders, UK August monthly GDP, construction output, industrial and manufacturing production, index of services, trade balance, Eurozone August industrial production

- Central banks: Fed’s FOMC meeting minutes, Fed’s Kashkari, Bowman and Barr speak, ECB’s Lagarde, Knot and de Cos speak, BoE’s Haskel, Pill and Mann speak

- Earnings: PepsiCo

Thursday October 13

- Data: US September CPI, initial jobless claims, UK September RICS house price balance, Japan September PPI, bank lending, Germany August current account balance

- Central banks: ECB’s Guindos speaks, BoE’s Mann speaks

- Earnings: TSMC, BlackRock, Walgreens Boots Alliance, Domino’s Pizza, Delta, Infosys

- Other: G20 central bankers and finance ministers meet

Friday October 14

- Data: US October University of Michigan survey, September retail sales advance, export and import price index, August business inventories, China September PPI, CPI, trade balance, Japan September M2, M3, Germany September wholesale price index, Italy August general government debt, Eurozone August trade balance, Canada September existing home sales, August manufacturing sales, wholesale trade sales

- Central banks: Fed’s Cook speaks, ECB’s Holzmann speaks, BoE’s quarterly bulletin

- Earnings: JPMorgan, Citi, Morgan Stanley, Wells Fargo, UnitedHealth

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the CPI report on Thursday and the retail sales and University of Michigan reports on Friday. The minutes from the September FOMC meeting will be released on Wednesday and there are several speaking engagements from Fed officials, including governors Brainard, Bowman, Cook, and Barr, as well as presidents Evans, Mester, Kashkari, George, and Bullard.

Monday, October 10

- 09:00 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will deliver remarks at the annual NABE conference in Chicago. On October 6, Evans said, “We have further to go…Inflation is high right now and we need a more restrictive setting of monetary policy…We have to look at the momentum in sort of that central component of inflation, and that’s really the part that I believe has most of my colleagues and myself nervous…In two meetings how do you do 125 basis points of increase? Well you can sort of make that choice yourself, right?”

- 01:00 PM Fed Vice Chair Brainard speaks: Fed Vice Chair Lael Brainard will deliver remarks at the NABE conference. Text and Q&A with moderator are expected. On September 30, Brainard said, “Inflation is very high in the US and abroad, and the risk of additional inflationary shocks cannot be ruled out…Monetary policy is focused on restoring price stability in a high-inflation environment…Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target. For these reasons, we are committed to avoiding pulling back prematurely.”

Tuesday, October 11

- 06:00 AM NFIB small business optimism, September (consensus 91.3, last 91.8)

- 12:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will deliver remarks at The Economic Club of New York. On October 6, Mester said, “We have to be singularly focused on inflation…If we want to get back to healthy conditions, this is something we have to do…We have to bring interest rates up to a level that will get inflation on that 2% path, and I have not seen the compelling evidence that I need to see that would suggest that we could start reducing the pace at which we’re going.”

Wednesday, October 12

- 08:30 AM PPI final demand, September (GS +0.2%, consensus +0.2%, last -0.1%); PPI ex-food and energy, September (GS +0.3%, consensus +0.3%, last +0.4%); PPI ex-food, energy, and trade, September (GS +0.2%, consensus +0.2%, last +0.2%): We estimate that PPI final demand increased by 0.2% in September. We estimate a 0.3% increase for PPI ex-food and energy and a 0.2% increase for PPI ex-food, energy, and trade.

- 10:00 AM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a discussion at the Northwoods Economic Development Summit. On October 6, Kashkari said, “We have more work to do…Until I see some evidence that underlying inflation has solidly peaked and is hopefully headed back down, I’m not ready to declare a pause. I think we’re quite a ways away from a pause.” He added, “I fully expect that there are going to be some losses and there are going to be some failures around the global economy as we transition to a higher-interest rate environment, and that’s the nature of capitalism…We need to keep our eyes open for risks that could be destabilizing for the American economy as a whole. But to me, the bar to actually shifting our stance on policy is very high…It should not be up to the Federal Reserve or the American taxpayer to bail people out.”

- 01:45 PM Fed Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will discuss new technologies, the Fed, and inclusion at an event hosted by Fannie Mae. Text and Q&A with moderator are expected.

- 02:00 PM FOMC meeting minutes, September 20-21 meeting: The FOMC increased the federal funds rate target range by 75bp to 3.00%-3.25% at its September meeting. The median dot in the Summary of Economic Projections showed a funds rate midpoint of 4.375% at end-2022 and 4.625% at end-2023. The FOMC’s revised projections provided the key takeaways from the September meeting: a 75bp hike is the baseline for November, and the FOMC is willing to tolerate more labor market deterioration if necessary if inflation remains high. Our baseline forecast calls for the Fed to deliver a 75bp rate hike in November, a 50bp hike in December, and a 25bp hike in February, for a peak rate of 4.5-4.75%. The main thing we will be looking for in the minutes is discussion regarding the bar for slowing the pace to something less than 75bp per meeting, whether in November or later.

- 06:30 PM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will discuss forward guidance as a monetary policy tool at an event hosted at New York University. Text and Q&A with audience are expected. On August 6, Bowman said she supports “the Committee’s view that ‘ongoing increases’ would be appropriate at coming meetings.” She added, “My view is that similarly-sized increases should be on the table until we see inflation declining in a consistent, meaningful, and lasting way.”

Thursday, October 13

- 08:30 AM CPI (mom), September (GS +0.26%, consensus +0.2%, last +0.1%); Core CPI (mom), September (GS +0.41%, consensus +0.4%, last +0.6%); CPI (yoy), September (GS +8.10%, consensus +8.1%, last +8.3%); Core CPI (yoy), September (GS +6.50%, consensus +6.5%, last +6.3%): We estimate a 0.41% increase in September core CPI (mom sa), which would boost the year-on-year rate by two tenths to 6.5%. Our forecast reflects a 2.5% decline in the used car category on the back of falling auction prices offset by strength in new car prices (+1.0%) reflecting the renewed decline in dealer incentives. We also expect continued strength in services inflation due to wage pressures, labor shortages, and elevated short-term inflation expectations. Specifically, we look for a strong set of shelter readings (rent +0.70% and OER +0.64%), a 2% rebound in airfares, and a 0.5% rise in education prices due to higher tuition and daycare costs for the new school year. We also expect another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.26% rise in headline CPI, reflecting higher gasoline and food prices.

- 08:30 AM Initial jobless claims, week ended October 8 (GS 200k, consensus 225k, last 219k); Continuing jobless claims, week ended October 1 (consensus 1,365k, last 1,361k): We estimate initial jobless claims decreased to 200k in the week ended October 8.

Friday, October 14

- 08:30 AM Retail sales, September (GS +0.5%, consensus +0.2%, last +0.3%); Retail sales ex-auto, September (GS +0.2%, consensus -0.1%, last -0.3%); Retail sales ex-auto & gas, September (GS +0.5%, consensus +0.2%, last +0.3%): Core retail sales, September (GS +0.5%, consensus +0.2%, last flat): We estimate core retail sales rose 0.5% in September (ex-autos, gasoline, and building materials; mom sa) following the flat reading in August. Our forecast reflects a boost from the rebound in consumer real incomes. High-frequency spending data also indicates continued strong demand for apparel and footwear and a further rise in restaurant spending, the latter of which is excluded from core retail sales but is included in the three higher-level aggregates. We estimate a 0.5% rise in headline retail sales, reflecting a rebound in auto sales but a pullback in gasoline prices.

- 08:30 AM Import price index, September (consensus -1.1%, last -1.0%); Export price index, September (consensus -1.0%, last -1.6%)

- 10:00 AM Business inventories, August (consensus +0.9%, last +0.6%)

- 10:00 AM University of Michigan consumer sentiment, October preliminary (GS 58.6, consensus 59.0, last 58.6): University of Michigan 5-10-year inflation expectations, October preliminary (GS 2.8%, consensus n.a., last 2.7%)

- We expect that the University of Michigan consumer sentiment index was unchanged at 58.6 in the preliminary October report.

- 10:00 AM Kansas City Fed President George (FOMC voter) speaks. Kansas City Fed President Esther George will discuss the economic outlook at an event hosted by S&P global. On September 9, George said, “With the policy rate still relatively low, the balance sheet still near $9 trillion and imbalances in the economy still holding up inflation, the case for continuing to remove policy accommodation remains clear-cut…weighing in on the peak policy rate is likely just speculation at this point.”

- 10:30 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will discuss the economic outlook at an event hosted by the National Bankers Association. A Q&A with a moderator and audience is currently expected. On October 6, Cook said, “Inflation remains stubbornly and unacceptably high, and data over the past few months show that inflationary pressures remain broad based…Aside from the immediate effect of higher prices on households and businesses, the longer it persists and the more people come to expect it, the greater the risks of elevated inflation becoming entrenched… it must come down, and we will keep at it until the job is done.”

Source: DB, Goldman, BofA