BY TYLER DURDEN …

MONDAY, DEC 12, 2022 – 06:55 AM …

In keeping with the holiday spirit, and while previewing the main events of the week, the last full trading week of 2022, DB’s Jim Reid writes that if he were to return to the spirit of financial market Christmases past, “this week would be about a client Xmas lunch Monday, client Xmas lunch Tuesday, team Xmas drinks Wednesday, firmwide office party on Thursday and mince pies on the trading floor on Friday.” Like a decadent Craig David song. Instead it will be UK monthly GDP on Monday, a huge US CPI print on Tuesday, we will be watching UK CPI and the FOMC on Wednesday, and on Thursday (ECB and BoE meetings) and Friday (global flash PMIs) and Saturday, we chill on Sunday “but not watching the World Cup final as England are cruelly out.”

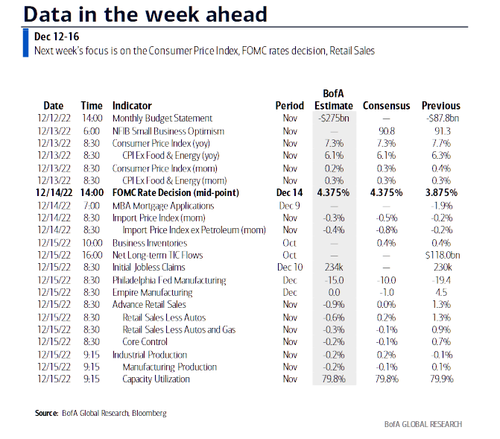

Reviewing the main highlights in more detail now. The Fed, the ECB and the BoE are all expected to downshift the pace of rate hikes to 50bps this week from 75bps at their last meetings. But first, US CPI…

Given the very close proximity to the FOMC it clearly has the ability to change the tone of the message, the statement and the dot plots but is highly unlikely to change the headline 50bps hike. DB economists expect a softer print than consensus with +0.21% unrounded on headline (vs. +0.44% previously and +0.3% consensus) and +0.29% on core (vs. +0.27%, +0.3% consensus). This would leave headline dropping from 7.7% to 7.2% (7.3% consensus) and from 6.3% to 6.1% for core. So a big day for financial markets.

In terms of more granularity around the Fed the following day, the dots will be fascinating. The likely 50bps hike will add to the 375bps seen so far this year but make a step down from a run of four successive 75bps moves. Economists think the recent Fedspeak justifies an increase in the median terminal dot to 4.9% but that there are compelling reasons for this to go to 5.1% – inline with the some more hawkish views for the terminal rate. This is due to financial conditions easing of late and no obvious near term signs that the labor market is slowing (aside from the mass tech sector layoffs of course). So all this will make February’s FOMC market pricing very interesting after the meeting. Economists also think the Fed will want to keep 50bps for the Feb meeting on the table but would at this stage prefer downshifting to 25bps. A 4.9% terminal dot might not give them as much optionality to do this as 5.1% would.

Over in Europe, a separate DB economist team is calling for a +50bps hike and a hawkish communications strategy but do not rule out one more +75bps hike before the downshift happens. They expect the decision and messaging to be in line with their expectations of a 3% terminal rate, with no rate cuts before the middle of 2024 and c.20% balance sheet contraction by the end of next year, mainly via TLTRO repayments.

The third major downshift will come from the BoE, also on Thursday. DB expects the central bank to hike by +50bps after last month’s +75bps increase, the only one in the current hiking cycle so far, taking the Bank Rate to 3.5%. He also expects the decision to be accompanied by dovish messaging amidst concerns over potential over-tightening. The risks of sticky inflation and wage pressures, among other factors, are expected to lead to a 4.5% terminal rate by May of next year (+50bps in February and +25bps in March and May). But growth concerns pose downside risks to the expectations.

After the major central bank decisions, we will get the flash PMIs for the US, Japan and Europe on Friday with US retail sales, industrial production the day before. Potentially adding to the volatility by the end of the week, will be triple witching on Friday when a record $3.7 trillion in options is set to expire.

The other highlights are in the usual day-by-day calendar of events at the end but UK CPI on Wednesday might be another focus after the YoY October CPI reading showed 11.1%, a multi-decade high.

One thing to watch today are surging short-term electricity prices in Europe, especially in the UK as sub-freezing temperatures and low winds lead to a fairly extreme near-term supply/demand imbalance.

Day-by-day calendar of events

Monday December 12

- Data: US November monthly budget statement, UK October monthly GDP, industrial and manufacturing production, index of services, construction output, trade balance, Japan November machine tool orders

- Earnings: Oracle

Tuesday December 13

- Data: US November CPI, NFIB small business optimism, UK November payroll employees monthly change, October average weekly earnings, unemployment rate, Japan October core machine orders, Q4 Tankan large and small manufacturing index, Germany December ZEW survey, October current account balance, Eurozone December ZEW survey, Italy October industrial production, France Q3 total payrolls

- Central banks: BoE’s financial stability report

Wednesday December 14

- Data: US November import price index, UK November RPI, CPI, October house price index, Japan November trade balance, October capacity utilization, Italy Q3 unemployment rate, Eurozone October industrial production, Canada October manufacturing sales

- Central banks: Fed’s decision

- Earnings: Inditex

Thursday December 15

- Data: US December Philadelphia Fed business outlook, Empire manufacturing index, November retail sales, industrial and manufacturing production, capacity utilization, October business inventories, initial jobless claims, China November industrial production, retail sales, property investment, Japan October Tertiary industry index, Germany November wholesale price index, Italy October general government debt, France December business and manufacturing confidence, EU27 November new car registrations, Canada November housing starts, existing home sales

- Central banks: BoE decision, ECB decision

- Earnings: Adobe

Friday December 16

- Data: US, UK, Japan, Germany, France, Eurozone December PMIs, UK December GfK consumer confidence, November retail sales, Italy and Eurozone October trade balance, Canada October wholesale trade sales

- Central banks: ECB’s Holzmann speaks

- Earnings: Accenture

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the CPI report on Tuesday, and the retail sales and Philly Fed manufacturing index reports on Thursday. The December FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, December 12

- There are no major economic data releases scheduled.

Tuesday, December 13

- 06:00 AM NFIB small business optimism, November (consensus 90.5, last 91.3)

- 08:30 AM CPI (mom), November (GS +0.20%, consensus +0.3%, last +0.4%); Core CPI (mom), November (GS +0.28%, consensus +0.3%, last +0.3%); CPI (yoy), November (GS +7.21%, consensus +7.3%, last +7.7%); Core CPI (yoy), November (GS +6.03%, consensus +6.1%, last +6.3%): We estimate a 0.28% increase in November core CPI (mom sa), which would lower the year-on-year rate by three tenths to 6.0%. Our forecast reflects a 3% decline in the used car category on the back of falling auction prices, as well a 1% drop in apparel prices reflecting increased holiday promotionality. We also assume a 1% pullback in hotel prices following last month’s jump. We assume a further moderation in new car inflation (+0.2% mom) as rebounding incentives offset the impact of price increases on 2023 models. We do not expect a rebound in the monthly pace of shelter inflation (we forecast rent +0.64% and OER +0.62%) as weakness in new rentals offsets the continued upward pressure on renewing leases. On the positive side, we assume a 2% rebound in airfares (mom sa). We also assume another gain in the car insurance category, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.20% rise in headline CPI, reflecting lower gasoline but higher food prices.

Wednesday, December 14

- 08:30 AM Import price index, November (consensus -0.5%, last -0.2%): Export price index, November (consensus -0.5%, last -0.3%)

- 02:00 PM FOMC statement, December 13-14 meeting: As discussed in our FOMC preview, aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023. We expect the median dot to rise 50bp to a new peak of 5-5.25%, in line with our own forecast for Fed policy next year as we continue to expect three 25bp hikes in 2023 to a peak of 5-5.25%, though the risks are tilted toward 50bp in February. Aside from the increase in the terminal rate, we do not expect major changes at the December meeting.

- Thursday, December 15

- 08:30 AM Empire State manufacturing survey, December (consensus -0.5, last +4.5)

- 08:30 AM Retail sales, November (GS -0.4%, consensus -0.2%, last +1.3%); Retail sales ex-auto, November (GS -0.3%, consensus +0.2%, last +1.3%); Retail sales ex-auto & gas, November (GS -0.2%, consensus +0.1%, last +0.9%); Core retail sales, November (GS -0.2%, consensus -0.1%, last +0.7%): We estimate core retail sales declined 0.2% in November (ex-autos, gasoline, and building materials; mom sa) following the 0.7% rise in October. Our forecast reflects lackluster online spending growth during Black Friday weekend and Cyber Monday. We also believe the spending strength in October creates a high hurdle for incremental spending growth, especially because October spending benefitted from stimulus checks in California. We estimate a 0.4% decline in headline retail sales, reflecting a pullback in auto sales and gasoline prices.

- 08:30 AM Philadelphia Fed manufacturing index, December (GS -12.4, consensus -10.0, last -19.4): We estimate that the Philadelphia Fed manufacturing index rebounded seven points to -12.4 in December, remaining in contractionary territory due to weak European and East Asian industrial trends.

- 08:30 AM Initial jobless claims, week ended December 10 (GS 235k, consensus 232k, last 230k); Continuing jobless claims, week ended December 3 (consensus 1,650k, last 1,671k): We estimate initial jobless claims increased to 235k in the week ended December 10.

- 09:15 AM Industrial production, November (GS flat, consensus +0.1%, last -0.1%); Manufacturing production, November (GS -0.1%, consensus -0.2%, last +0.1%); Capacity utilization, November (GS 79.7%, consensus 79.8%, last 79.9%): We estimate industrial production was flat in November, as strong electric utilities production is offset by weak auto production. We estimate capacity utilization edged down to 79.7%.

- 10:00 AM Business inventories, October (consensus +0.4%, last +0.4%)

Friday, December 16

- 09:45 AM S&P Global US manufacturing PMI, December preliminary (consensus 47.9, last 47.7); S&P Global US services PMI, December preliminary (consensus 46.5, last 46.2)

- 12:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will discuss the economic outlook during a moderated discussion hosted by the American Enterprise Institute. A Q&A with audience is expected. Discussing the monetary policy outlook on November 21, Daly said, “Now we’re at a point where we are less clear on the destination. And so being more judicious in the pace to me seems like an appropriate thing to consider. But I don’t want to call it even because we have more information coming in…As we make decisions about further rate adjustments, it will be important to remain conscious of this gap between the federal funds rate and the tightening in financial markets. Ignoring it raises the chances of tightening too much.” She added, “Labor markets remain solid but are showing early signs of cooling. Job openings are down about 10 percent from their March high and job growth is slowing from its rapid pace last year.”

Source: DB, Goldman, BofA