Monday, Nov 11, 2024 …

Although it’s Veterans’ Day today, with US bond markets closed (equities are open), it’s another important week with US CPI (Wednesday) the focal point, even though many will argue that the year is now basically over with the biggest events in the rearview mirror. Indeed, as DB’s Jim reid writes, US data may not be as heavily scrutinized as usual at the moment as with the Trump victory, the market might conclude that there may be changes in animal spirits in the near-term and policy in the medium-term. On this, any clues on Trump’s appointments may be market moving. Case in point the Dollar’s rise immediately after the FT reported late Friday afternoon UK time that Robert Lighthizer would be asked to be the US Trade Representative in the new administration. Given how central he’s been to Trump’s views on trade it was surprising that the market was surprised. However there has been no confirmation of this appointment and other wires have suggested no such approach has been made.

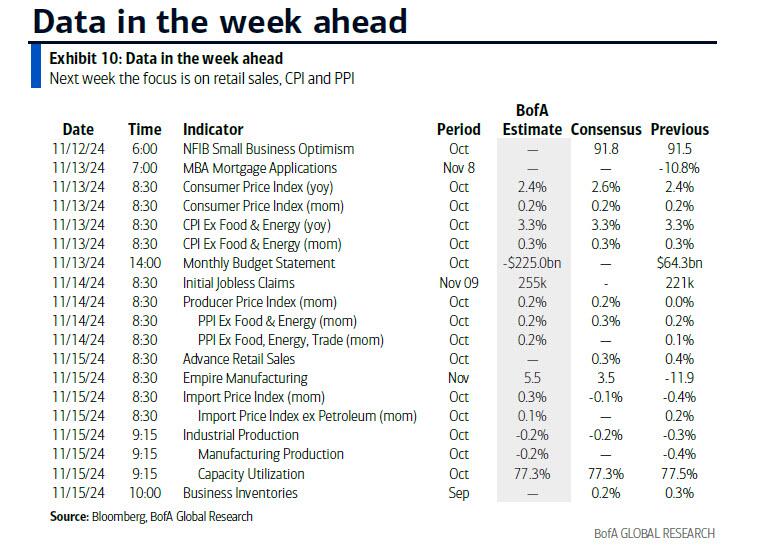

Having said that US data might not be the most important events of the week, outside of CPI the US highlights are the Fed’s senior loan officers survey (SLOOS) tomorrow, PPI on Thursday and retail sales, on Friday. There are a lot of Fed speakers so their view of policy post the election will be interesting after Powell navigated this uncertainty well last week. Powell himself speaks again on Thursday.

Internationally the key events will be UK employment and the German ZEW tomorrow, Japanese and Eurozone GDP alongside the ECB account of the October meeting on Thursday, and China’s main monthly data dump on Friday. See the full week ahead in the day-by-day calendar at the end as usual.

In terms of US CPI, DB’s economists suggest that softer energy prices should lead headline CPI (+0.20% forecast vs. +0.18% previously) to be weaker than core (+0.26% vs. +0.31%) leading to a YoY rate that picks up a tenth in the headline to 2.5% but with core staying steady at 3.3% even if the 6-month rate would dip a tenth to 2.5%. Remember though that in the last several years the second half has been more seasonally favorable to inflation so it’s possible we’re coming towards the end of that help.

For context, and due to the election result, DB’s economists are leaning towards core PCE inflation being upgraded from 2.2% in 2025 to around 2.5% and by around 0.5pp to 2.5% in 2026 as tariffs kick in. For growth the 2025 upgrade is likely to be from 2.2% to 2.5-2.75% but with 2026 downgraded a few tenths to 2% as tariffs offset the fiscal boosts. So the outlook becomes more complicated from here with most uncertainty around how aggressive the tariff regime will be. As a result, DB’s economists believe now that the Fed may not be able to cut below 4%. Back in mid-September Dec 2025 Fed futures contracts were pricing in 2.78% so this is yet another example (around the 8th time) in this cycle where the market has got far, far too optimistic in terms of how much the Fed will be able to cut rates.

Courtesy of DB, here is a day-by-day calendar of events

Monday November 11

- Data: Japan October Economy Watchers survey, M2, M3, Denmark and Norway October CPI

- Earnings: Live Nation Entertainment, Salzgitter

Tuesday November 12

- Data: US October NFIB small business optimism, NY Fed 1-yr inflation expectations, UK September average weekly earnings, unemployment rate, October jobless claims change, Japan October machine tool orders, PPI, Germany November Zew survey, September current account balance, Eurozone November Zew survey, Canada September building permits

- Central banks: Fed’s SLOOS, Waller, Barkin and Harker speak, ECB’s Rehn, Centeno and Cipollone speak

- Earnings: Home Depot, AstraZeneca, Shopify, Spotify, Tokyo Electron, Occidental Petroleum, Infineon, Bayer, Vodafone

Wednesday November 13

- Data: US October CPI, monthly budget statement

- Central banks: Fed’s Logan, Musalem and Schmid speak, BoE’s Mann speaks

- Earnings: Tencent, Cisco, Allianz, Siemens Energy, RWE

Thursday November 14

- Data: US October PPI, initial jobless claims, UK October RICS house price balance, Japan Q3 GDP, Eurozone Q3 GDP

- Central banks: Fed’s Powell, Barkin and Williams speak, ECB’s account of the October meeting, Schnabel and Guindos speak, BoE’s Bailey speaks

- Earnings: Walt Disney, Siemens, Applied Materials, Deutsche Telekom, Mitsubishi UFJ Financial, JD.com, Burberry

Friday November 15

- Data: US November Empire manufacturing index, October retail sales, industrial production, import and export price index, capacity utilisation, September business inventories, China October retail sales, industrial production, property investment, new home prices, UK September monthly GDP, Japan September Tertiary industry index, capacity utilisation, Germany October wholesale price index, Italy September general government debt, trade balance, Canada September manufacturing sales, October existing home sales, European Commission Economic Forecasts

- Central banks: ECB’s Lane and Cipollone speak

- Earnings: Alibaba

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Friday. There are several speaking engagements from Fed officials this week, including speeches by Chair Powell and New York Fed President Williams on Thursday.

Monday, November 11

- Veterans Day. There are no major economic data releases scheduled. NYSE will be open. SIFMA recommends that bond markets remain closed.

Tuesday, November 12

- 06:00 AM NFIB small business optimism, October (consensus 92.0, last 91.5)

- 10:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver a speech and take part in a moderated Q&A at the 2024 Clearing House Annual Conference. Text is expected. On October 14th, before the release of the October employment report, Waller noted that he expects “payroll gains to moderate from their current pace but continue at a solid rate,” noting that “the unemployment rate may drift a bit higher but is likely to remain quite low in historical terms.”

- 10:15 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Tom Barkin will deliver a speech at an event in Baltimore. Text and Q&A are expected. On October 10th, Barkin noted that, while he “wouldn’t declare victory” on inflation, “we’re definitely headed in the right direction.” He characterized the labor market as a “low hiring, low firing environment” and noted that “unit labor costs are not driving inflationary pressures.”

- 02:00 PM Senior Loan Officer Opinion Survey released

- 02:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a moderated conversation on Yahoo Finance. On October 21st, Kashkari said he expected “some more, modest cuts over the next several quarters to get to something around neutral, but it’s going to depend on the data.” Kashkari also noted that the economy had “continued to perform quite well” despite the FOMC’s interest rate increases since 2022, which he said made him “wonder [whether] maybe the neutral rate that balances everything out is higher than it was before the pandemic.”

- 05:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will deliver a speech on fintech, artificial intelligence, and the changing financial landscape at an event hosted by Carnegie Mellon University. Text and Q&A are expected.

- 05:30 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Tom Barkin will speak to Salisbury-Wicomico Economic Development. He is expected to repeat his speech from earlier that day. Audience Q&A is expected.

Wednesday, November 13

- 08:30 AM CPI (MoM), October (GS +0.19%, consensus +0.2%, last +0.2%); Core CPI (MoM), October (GS +0.31%, consensus +0.3%, last +0.3%); CPI (YoY), October (GS +2.43%, consensus +2.6%, last +2.4%); Core CPI (YoY), October (GS +3.30%, consensus +3.3%, last +3.3%): We estimate a 0.31% increase in October core CPI (month-over-month SA), which would leave the year-over-year rate unchanged on a rounded basis at 3.3%. Our forecast reflects an increase in used car prices (+2.5%) reflecting a rebound in auction prices, another increase in airfares (+1.0%) reflecting a slight boost from residual seasonality and strong pricing trends, and another firm increase in the car insurance category (+0.5%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect roughly unchanged shelter components (OER +0.33%, primary rent +0.28%). The source data for the health insurance component is updated semiannually with the April and October reports. After swinging sharply between 2019-2023, methodological updates implemented last year have since kept health insurance inflation rangebound, and we expect similarly dampened readings over the next six months (we forecast -0.1% for October). We estimate a 0.19% rise in headline CPI, reflecting higher food prices (+0.2%) but lower energy prices (-1.3%). Our forecast is consistent with a 0.24% increase in core PCE in October. We will update our core PCE forecast after the CPI is released and again after the PPI is released.

- 09:45 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver opening remarks at an energy conference hosted by the Dallas and Kansas City Feds. Text is expected. On October 9th, Logan noted that the risks that aggregate demand proves stronger than expected or financial conditions boost demand beyond what the economy can sustain “suggest the FOMC should not rush to reduce the fed funds target to a “normal” or “neutral” level but rather should proceed gradually while monitoring the behavior of financial conditions, consumption, wages and prices.”

- 01:00 PM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will deliver a speech on the US economy and monetary policy at the Economic Club of Memphis. Text and Q&A are expected. On October 7th, Musalem noted that he saw “the costs of easing too much too soon as greater than the costs of easing too little too late.”

- 01:30 PM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeffrey Schmid will deliver a speech at an energy conference hosted by the Dallas and Kansas City Feds. Text is expected. On October 21st, Schmid noted that “while the loosening of the labor market has led to some concern that the economy is on shaky ground, my read is that we are seeing a normalization rather than a significant deterioration of conditions.” He also said that he thought “interest rates could settle well above the levels we saw in the decade before the pandemic.”

Thursday, November 14

- 07:00 AM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will deliver a speech on central bank independence and the economic outlook at the Latin American and Caribbean Economic Association in Uruguay. Text and audience and moderated Q&A are expected. On October 8th, Governor Kugler noted that, while she believed “the focus should remain on continuing to bring inflation to 2 percent,” she nevertheless supported “shifting attention to the maximum employment side of the FOMC’s dual mandate.”

- 08:30 AM PPI final demand, October (GS +0.2%, consensus +0.2%, last flat); PPI ex-food and energy, October (GS +0.3%, consensus +0.3%, last +0.2%); PPI ex-food, energy, and trade, October (GS +0.2%, consensus +0.2%, last +0.1%);

- 08:30 AM Initial jobless claims, week ended November 9 (GS 220k, consensus 223k, last 221k); Continuing jobless claims, week ended November 2 (last 1,892k)

- 09:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Tom Barkin will take part in a discussion with Jodie McLean, chair of the Richmond Fed’s board of directors and secretary of the Real Estate Roundtable board of directors. Q&A is expected.

- 03:00 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will deliver a speech on the economic outlook at an event hosted by the Dallas Fed, the Dallas Regional Chamber, and the World Affairs Council of Dallas/Fort-Worth. Text and moderated Q&A are expected. At the press conference following the November FOMC meeting, Chair Powell did not provide guidance about the December meeting and made it clear that the FOMC will not respond until it has greater clarity, saying “We don’t guess, we don’t speculate, and we don’t assume.” He said twice that the labor market is continuing to cool and the FOMC does not want further cooling, which we see as consistent with our view that Fed officials will want to see several months of labor market stabilization before slowing the pace.

- 04:15 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a speech titled “Making Missing Markets” at an event hosted by the New York Fed. Text is expected. On October 10th, Williams noted that “a wide range of metrics … indicate that the very tight labor market of the past few years has now returned to more normal conditions and is unlikely to be a source of inflationary pressures going forward” and said he expected “the unemployment rate to edge up from its current level of about 4 percent to around 4-1/4 percent at the end of this year and stay around that level next year.” Williams also said that “the data paint a picture of an economy that has returned to balance,” and that the FOMC should therefore “continue the process of moving the stance of monetary policy to a more neutral setting over time.”

Friday, November 15

- 08:30 AM Empire State manufacturing survey, November (consensus flat, last -11.9)

- 08:30 AM Retail sales, October (GS +0.4%, consensus +0.3%, last +0.4%)l Retail sales ex-auto, October (GS +0.3%, consensus +0.3%, last +0.5%); Retail sales ex-auto & gas, October (GS +0.3%, consensus +0.3%, last +0.7%); Core retail sales, October (GS +0.3%, consensus +0.3%, last +0.7%): We estimate core retail sales expanded 0.3% in October (ex-autos, gasoline, and building materials; month-over-month SA), reflecting healthy growth in measures of card spending. We estimate a 0.4% increase in headline retail sales, reflecting lower gasoline prices but higher auto sales.

- 08:30 AM Import price index, October (consensus -0.1%, last -0.4%); Export price index, October (consensus -0.1%, last -0.7%)

- 09:15 AM Industrial production, October (GS -0.4%, consensus -0.3%, last -0.3%); Manufacturing production, October (GS -0.5%, consensus -0.5%, last -0.4%); Capacity utilization, October (GS 77.1%, consensus 77.1%, last 77.5%): We estimate industrial production declined 0.3%, reflecting weak natural gas and mining production and a drag from recent hurricanes. We estimate capacity utilization declined to 77.1%.

- 10:00 AM Business inventories, September (consensus +0.2%, last +0.3%)

Source: DB, Goldman