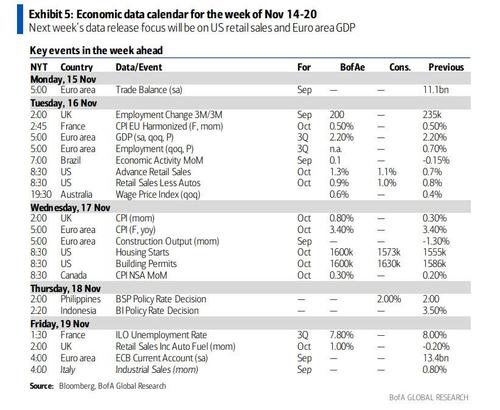

There’ll be an increasing amount of hard data out of the US for October, including retail sales, industrial production (both Tuesday) and housing starts (Wednesday). Meanwhile, there’ll also be some important UK data as the Bank of England mulls over their monetary policy settings ahead of their meeting next month. On Tuesday, there’s the latest employment report, and then on Wednesday, we’ll get the latest CPI reading for October.

* * *

Finally, here is Goldman with a focus just on the US, where the key economic data releases this week are the retail sales report on Tuesday and the Philadelphia Fed manufacturing index on Thursday. There are several scheduled speaking engagements from Fed officials this week, including a speech by Vice-Chair Clarida on global monetary policy coordination on Friday.

Monday, November 15

- 08:30 AM Empire State manufacturing survey, November (consensus +21.6, last +19.8)

Tuesday, November 16

- 08:30 AM Retail sales, October (GS +1.1%, consensus +1.3%, last +0.7%); Retail sales ex-auto, October (GS +0.7%, consensus +1.0%, last +0.8%); Retail sales ex-auto & gas, October (GS +0.5%, consensus +0.7%, last +0.7%); Core retail sales, October (GS +0.5%, consensus +0.9%, last +0.8%): We estimate a 0.5% increase in core retail sales (ex-autos, gasoline, and building materials) in October (mom sa). The Census measure is somewhat elevated relative to other high-frequency spending measures, and we believe the sunset of income-support programs weighed on some discretionary retail categories in the month following the strong back-to-school shopping season. We estimate a 1.1% increase in headline retail sales, reflecting rebounding auto sales and higher auto and gas prices.

- 08:30 AM Import price index, October (consensus +1.0%, last +0.4%)

- 09:15 AM Industrial production, October (GS +1.1%, consensus +0.8%, last -1.3%); Manufacturing production, October (GS +1.0%, consensus +0.9%, last -0.7%); Capacity utilization, October (GS 76.0%, consensus 75.8%, last 75.2%): We estimate industrial production rose by 1.1% in October, reflecting strength in oil and gas production and motor vehicle output, and a post-Hurricane rebound in areas affected by Ida. We estimate capacity utilization rose by 0.8pp to 76.0%.

- 10:00 AM Business inventories, September (consensus +0.6%, last +0.6%)

- 10:00 AM NAHB housing market index, November (consensus 80, last 80)

- 12:00 PM Richmond Fed President Barkin (FOMC voter), Kansas City Fed President George (FOMC non-voter), and Atlanta Fed President Bostic (FOMC voter) speak: Richmond Fed President Thomas Barkin, Kansas City Fed President Esther George, and Atlanta Fed President Raphael Bostic will take part in a discussion on racism and the economy, hosted by the Minneapolis Fed.

- 03:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will speak at the Commonwealth Club. Media Q&A is expected.

Wednesday, November 17

- 08:30 AM Housing starts, October (GS +1.0%, consensus +1.6%, last -1.6%); Building permits, October (consensus +2.8%, last -7.8%): We estimate housing starts increased by 1.0% in October, reflecting lower permits in September.

- 09:10 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at the Treasury Market Conference, hosted by the Treasury Department and the Fed’s Board of Governors. Prepared text is expected.

- 11:00 AM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will deliver introductory remarks at a virtual roundtable on the Fed’s Accounting Communication Network, hosted by the Dallas Fed.

- 11:20 AM Cleveland Fed President Mester (FOMC non-voter) and Governor Waller (FOMC voter) speak: Cleveland Fed President Loretta Mester will introduce Fed Governor Christopher Waller, who will discuss stablecoins at the Cleveland Fed’s 2021 Financial Stability Conference. Prepared text and moderated Q&A are expected.

- 12:40 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will speak to Rostin Behnam (acting chair of the Commodities Futures Trading Commission) in a fireside chat hosted by the New York Fed.

- 4:05 PM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will take part in a moderated Q&A hosted by the Mid-Size Bank Coalition of America.

- 4:10 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will make closing remarks at a virtual conference on community development hosted by the Fed.

Thursday, November 18

8:00 AM Atlanta Fed President Bostic (FOMC voter) speaks; Atlanta Fed President Raphael Bostic will discuss the regional outlook at a virtual event hosted by the Metro Atlanta Chamber.

08:30 AM Initial jobless claims, week ended November 13 (GS 265k, consensus 260k, last 267k); Continuing jobless claims, week ended November 6 (last 2,160k)

We estimate initial jobless claims decreased to 265k in the week ended November 13; 08:30 AM Philadelphia Fed manufacturing index, November (GS 23.0, consensus 24.0, last 23.8): We estimate that the Philadelphia Fed manufacturing index declined by 0.8pt to 23.0 in November, reflecting continued production constraints.

9:30 AM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will speak on the transatlantic economic policy responses to the pandemic at an event hosted by the European Commission, the New York Fed, and the Centre for Economic Policy Research.

11:00 AM Kansas City Fed manufacturing index, November (consensus 30, last 31)

2:00 PM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will take part in a moderated Q&A hosted by the BKD Financial Services Symposium. Audience and media Q&A are expected.

3:30 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will take part in a Fed Listens event about the pandemic recovery and care work.

Friday, November 19

- 10:45 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Chris Waller will give a speech on the economic outlook at an event hosted by the Financial Stability Club in New York. Prepared text and Q&A are expected.

- 12:15 PM Fed Vice-Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will discuss global monetary policy coordination, cooperation, and collaboration at a virtual event hosted by the San Francisco Fed. Prepared text and moderated Q&A are expected.

Source: DB, BofA, Goldman