After several furious weeks of economic data, earnings and central bank announcements, it is a somewhat quieter week and looking forward, there’s not a standout event to focus on this week according to DB’s Jim Reid, even if there will be plenty to keep all occupied. US retail sales (tomorrow) is the highlight alongside Powell’s speech the same day. There will also be US housing data scattered across the week and UK and Japanese inflation on Wednesday and Friday respectively.

Let’s start with US retail sales as it will be a good early guide for Q2 GDP. DB’s economists are anticipating a +1.7% print, up from +0.7% in March and above the 1.0% consensus print. Rebounding auto sales should help the headline number. US industrial production is out the same day.

US housing will also be a big focus next week. It’s probably too early for the highest mortgage rates since 2009 to kick in but with these rates around 220bps higher YTD, some damage will surely soon be done after the highest YoY price appreciation outside of an immediate post WWII bounce, in DB’s 120+ year housing database. On this we will see the NAHB housing market index (tomorrow), April’s US building permits and housing starts (Wednesday), and existing home sales (Thursday).

We also have a long list of central bank speakers this week headed by Powell and Lagarde (tomorrow) and BoE Bailey today. There are many more spread across the week and you can see the list in the day by day event list at the end. We do have the last ECB meeting minutes on Thursday but the subsequent push towards a July hike might make these quite dated.

Turning to corporate earnings, it will be another quiet week after 457 of the S&P 500 companies and 368 of the STOXX 600 companies have reported earnings this season so far. Yet, it will be an important one to gauge how the US consumer is faring amid inflation at multi-decade highs, including reports such as Walmart, Home Depot (tomorrow), Target and TJX (Wednesday).

Results will also be due from China’s key tech and ecommerce companies like JD.com (tomorrow), Tencent (Wednesday) and Xiaomi (Thursday). Other notable corporate reporters will include Cisco (Wednesday), Applied Materials, Palo Alto Networks (Thursday) and Deere (Friday).

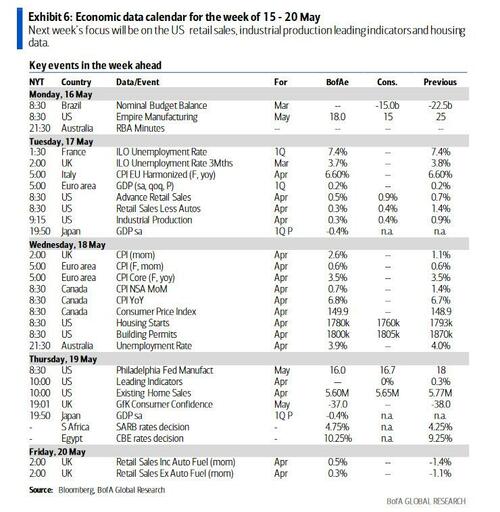

Courtesy of DB, here is a day-by-day calendar of events:

Monday May 16

- Data: US May Empire manufacturing index, China April industrial production, retail sales, property investment, residential property sales, Japan April PPI, machine tool orders, Germany April wholesale price index, Eurozone March trade balance, Canada April housing starts, March manufacturing, wholesale trade sales

- Central banks: Fed’s Williams speaks, ECB’s Lane, Villeroy and Panetta speak, BOE’s Bailey, Ramsden, Haskel and Saunders speak

- Earnings:Ryanair, Take-Two Interactive

- Other: EU Commission releases economic forecasts

Tuesday May 17

- Data: US May NAHB housing market index, April retail sales, industrial production, capacity utilisation, manufacturing production, March business inventories, Japan March tertiary industry index, France Q1 ILO unemployment rate, UK April jobless claims change, March average weekly earnings, ILO unemployment rate, Italy March trade balance, Eurozone Q1 employment, GDP

- Central banks: Fed’s Powell, Bullard, Harker, Evans, Kashkari and Mester speak, ECB’s Lagarde and Centeno speak, BoE’s Cunliffe speaks

- Earnings: Walmart, Home Depot, JD.com, Vodafone

Wednesday May 18

- Data: US April building permits, housing starts, China April new home prices, Japan Q1 GDP, March capacity utilisation, UK April CPI, RPI, PPI, March house price index, EU27 April new car registrations, Canada April CPI

- Central banks: Fed’s Harker speaks

- Earnings: SQM, Tencent, Cisco, Lowe’s, Target, TJX

- Other: G7 central bankers and finance ministers meet in Germany until May 20th

Thursday May 19

- Data: US May Philadelphia Fed business outlook, initial jobless claims, April existing home sales, leading index, Japan April trade balance, March core machine orders, Italy March current account, Eurozone March construction output, Canada April industrial product and raw materials price indices

- Central banks: ECB publishes account of the April meeting,Fed’s Kashkari speaks,ECB’s Guindos and Holzmann speak

- Earnings: Xiaomi, Applied Materials, Palo Alto Networks, Kohl’s, easyJet

Friday May 20

- Data: China 1-year and 5-year loan prime rate, Japan April national CPI, Eurozone May consumer confidence, Germany April PPI, UK May GfK consumer confidence, April retail sales

- Central banks: BoE’s Pill speaks

- Earnings: Deere

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are retail sales on Tuesday and Philly Fed manufacturing index on Thursday. There are several scheduled speaking engagements by Fed officials this week, including Chair Powell on Tuesday.

Monday, May 16

- 08:30 AM Empire State manufacturing survey, May (consensus +15.0, last +24.6)

- 08:55 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a moderated discussion during an event hosted by the Mortgage Bankers Association in New York.

Tuesday, May 17

- 08:00 AM St. Louis Fed President Bullard (FOMC voter) speaks; St. Louis Fed President James Bullard will discuss the outlook for the economy and monetary policy at a virtual conference hosted by the Energy Infrastructure Council.

- 08:30 AM Retail sales, April (GS +1.3%, consensus +1.0%, last +0.7%); Retail sales ex-auto, April (GS +0.6%, consensus +0.4%, last +1.42%); Retail sales ex-auto & gas, April (GS +0.8%, consensus +0.7%, last +0.7%); Core retail sales, April (GS +0.9%, consensus +0.8%, last +0.7%): We estimate a 0.9% rise in April core retail sales (ex-autos, gasoline, and building materials; mom sa) following the upwardly revised 0.7% gain in March. While tighter financial conditions are likely weighing on consumer sentiment and discretionary spending, high-frequency data suggest retail sales held up for most of the month. On the negative side, we look for a modest pullback in restaurant spending. We estimate a 1.3% rise in headline retail sales, reflecting higher auto sales and auto prices but a pullback in gasoline prices.

- 09:15 AM Industrial production, April (GS +0.7%, consensus +0.5%, last +0.9%); Manufacturing production, April (GS +0.3%, consensus +0.4%, last +0.9%); Capacity utilization, April (GS 78.8%, consensus 78.5%, last 78.3%): We estimate industrial production rose by 0.7% in April, reflecting strong mining and natural gas production. We estimate capacity utilization increased to 78.8%.

- 09:15 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss healthcare as an economic driver. Text and audience Q&A are expected.

- 10:00 AM Business inventories, March (consensus +1.9%, last +1.5%)

- 10:00 AM NAHB housing market index, May (consensus 75, last 77)

- 12:30 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a moderated town hall event hosted by the Sault Ste. Marie Chamber of Commerce. Audience Q&A is expected.

- 02:00 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Powell will be interviewed during a Wall Street Journal live event. Moderator Q&A is expected.

- 02:30 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will give opening remarks at a virtual panel discussion hosted by her bank.

- 06:45 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss the outlook for the economy and monetary policy at an event hosted by the Money Marketeers of New York University. Text and Q&A with both audience and moderator are expected.

Wednesday, May 18

- 08:30 AM Housing starts, April (GS -2.2%, consensus -1.8%, last +0.3%); Building permits, April (consensus -3.1%, last revised +0.3%): We estimate housing starts decreased by 2.2% in April, reflecting an increase in mortgage rates.

- 04:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discusss the economic outlook at a virtual event hosted by the Mid-Size Bank Coalition of America. Text and audience Q&A are expected.

Thursday, May 19

- 08:30 AM Philadelphia Fed manufacturing index, May (GS 15.0, consensus 16.5, last 17.6); We estimate that the Philadelphia Fed manufacturing index declined by 2.6pt to 15.0 in May, reflecting a sentiment drag and renewed supply chain disruptions related to China covid lockdowns and the ongoing conflict in Ukraine.

- 08:30 AM Initial jobless claims, week ended May 14 (GS 193k, consensus 200k, last 203k); Continuing jobless claims, week ended May 7 (consensus 1,330k, last 1,343k): We estimate that initial jobless claims dropped to 193k in the week ended May 14.

- 04:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a discussion about the impact of inflation on low-income households hosted by the Urban Institute.

Friday, May 20

- 10:00 AM Existing home sales, April (GS -2.0%, consensus -2.5%, last -2.7%); We estimate that existing home sales declined 2.0% in April.

Source: DB, Goldman, BofA