BY TYLER DURDEN … MONDAY … JUN 13, 2022 – 07:17 AM …

While the week starts slow on the data front – if not in the widespread liquidation gripping all markets – things pick up fast in the next few days, and this week is squarely and firmly all about the FOMC meeting on Wednesday. We go into it with the 2yr US note up +25bps on Friday and another c.+15bps this morning, which briefly re-inverted the 2s10s curve, in some clearly dramatic moves.

The problem as we enter the next couple of Fed and ECB meetings – as DB’s Jim Reid exmplains this morning – is that the central banks haven’t quite been able to let go of forward guidance and are a little trapped. To recap, forward guidance has prevented the Fed and the ECB from hiking as early as they needed to, largely because both saw the need to gradually wind down asset purchases over several months first as promised. However this hasn’t deterred them, and they have continued to try to flag their intentions to the market in advance with the Fed having previously all but signaled a 50bps this Wednesday, as well as in July, with the ECB now signalling 25bps in July and a strong possibility of 50bps in September. Of course, the market is already preparing for a “shock” with odds of a 75bps Wednesday rate hike rising as high as 44% this morning.

And as Reid adds, “Providing clarity is admirable but in the wake of another shocking US CPI print on Friday, should a 75bps hike not be a serious consideration? It seems strange that most think policy needs to be restrictive but that it’s going to take several meetings to get there from a still highly accommodative position.”

Indeed, without the recent Fed guidance, 75bps would be firmly on the table for Wednesday according to Reid who adds that “this is highly unlikely this week, but our economists think they could break cover from their own guidance and leave the door open for 75bps in July.”

DB Research has long been at the hawkish end on inflation and the Fed, and on Friday the bank’s economists further raised their hiking expectations. In addition to 50bps at the next two meetings they have now added 50bps in September and November, before a return to 25bps in December (to 3.125%). They now see the peak at 4.125% in mid-2023. This is closer to the 5% view in the “Why the upcoming recession will be worse than expected” that David Folkerts-Landau, Peter Hooper and Jim Reid published back in April. If we do have a terminal Fed rate approaching a 5-handle it does raise the question as to where 10yr yields top out (the outcome will most likely be an inverted curve but it would likely mean the 4.5-5% range discussed in the note from April, mentioned above, is within reason).

Moving on, it’s not just the Fed this week as the BoE (Thursday) and the BoJ (Friday) will also meet. DB expects a +25bps hike this week and updated their terminal rate forecast from 1.75% to 2.5%. Staying in the UK, labor market data releases will be out tomorrow with retail sales on Friday.

The week will conclude with a decision from the BoJ and how they address pressures from the yen hovering around a 20-year low, as well as the growing monetary policy divergence between Japan and other G7 economies. While not much will be announced this week, economists eventually expect a shortening or even the abandonment of yield curve control in H2 2023.

In data terms we go back to the US for the main highlights, with PPI (tomorrow) and retail sales (Friday) the main events. China’s key May indicators on Wednesday will also have global implications as we await industrial production, retail sales and property investment numbers.

Elsewhere in the US, we have June’s Philadelphia Fed business outlook (Wednesday), and May industrial production and capacity utilisation (Friday) numbers. April business inventories will be out on Wednesday and provide markets with a check on corporate stockpiling after Target’s renewed warning last week. Finally, a slew of housing market data is due. This includes the June NAHB housing market index (Wednesday) and May building permits and housing starts (Thursday). The impact of rising mortgage rates will be in focus.

In Europe, Germany’s ZEW survey for June (tomorrow) is among the key data highlights. We will also see April industrial production and trade balance data for the Eurozone on Wednesday and Eurozone construction output and April trade balance data for Italy on Friday. ECB speakers will also be on the radar for investors as they tend to start to break the party line on the Monday after the ECB meeting. A lengthy line up includes ECB President Lagarde on Wednesday and six other speakers.

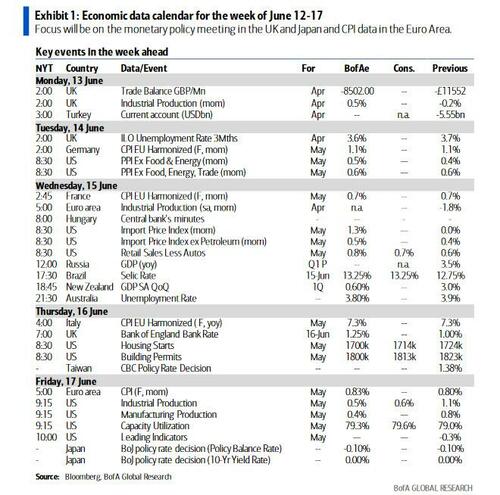

Corutesy of DB, here is a day-by-day calendar of events:

Monday June 13

- Data: UK April monthly GDP, construction output, industrial and manufacturing production, index of services, trade balance, Italy Q1 unemployment rate

- Central banks: ECB’s Holzmann, Simkus and Guindos speak

- Earnings: Oracle

Tuesday June 14

- Data: US May NFIB small business optimism, PPI, Japan April capacity utilisation, UK May jobless claims, April weekly earnings, ILO unemployment rate, Germany and Eurozone June ZEW survey, Canada April manufacturing sales

- Central banks: ECB’s Schnabel speaks

Wednesday June 15

- Data: US June Empire manufacturing, NAHB housing market index, May retail sales, import price index, April business inventories, China May industrial production, retail sales, fixed assets, property investment, jobless rate, residential property sales, Japan April core machine orders, tertiary industry index, Italy April general government debt, Eurozone April industrial production, trade balance, Canada May housing starts, existing home sales

- Central banks: Fed decision, ECB’s Lagarde, Nagel, De Cos, Panetta, Knot and Centeno speak

Thursday June 16

- Data: US June Philadelphia Fed business outlook, May building permits, housing starts, initial jobless claims, China May new home prices, Japan May trade balance, EU27 May new car registrations, Eurozone Q1 labour costs, Canada April wholesale trade sales

- Central banks: BoE decision, ECB’s Visco, Villeroy, Panetta, Vasle, Guindos, Knot, Centeno, De Cos and Makhlouf speak

- Earnings: Adobe

Friday June 17

- Data: US May industrial and manufacturing production, capacity utilisation, leading index, UK May retail sales, Eurozone April construction output, Italy April trade balance, Canada May industrial production, raw materials price index

- Central banks: BoJ decision, Fed’s Powell speaks

* * *

Focusing on just the US, Goldman notes that the key economic data releases this week are retail sales on Wednesday and the Philly Fed manufacturing index on Thursday. The June FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM. Chair Powell and Governor Waller also have speaking engagements scheduled later this week.

Monday, June 13

- There are no major economic data releases scheduled.

- 02:00 PM Fed Vice Chair Brainard (FOMC voter) speaks: Fed Vice Chair Lael Brainard will discuss the Community Reinvestment Act in a pre-recorded video and an audience Q&A. Note the Vice Chair is not expected to discuss monetary policy given the FOMC blackout period.

Tuesday, June 14

- 06:00 AM NFIB small business optimism, May (consensus 93.0, last 93.2)

- 08:30 AM PPI final demand, May (GS +0.9%, consensus +0.8%, last +0.5%): PPI ex-food and energy, May (GS +0.7%, consensus +0.6%, last +0.4%); PPI ex-food, energy, and trade, May (GS +0.7%, consensus +0.5%, last +0.6%): We estimate a 0.7% increase for PPI ex-food and energy and PPI ex-food, energy, and trade, reflecting slightly softer—but still elevated—core goods inflation that is more than offset by a reacceleration in services inflation (which was flat in April after averaging 0.9% mom over the three prior months). We estimate that headline PPI increased by 0.9% in May.

Wednesday, June 15

- 08:30 AM Empire State manufacturing survey, June (consensus +3.0, last -11.6)

- 08:30 AM Retail sales, May (GS -0.5%, consensus +0.1%, last +0.9%); Retail sales ex-auto, May (GS flat, consensus +0.7%, last +0.6%); Retail sales ex-auto & gas, May (GS -0.3%, consensus +0.4%, last +1.0%); Core retail sales, May (GS -0.1%, consensus +0.3%, last +1.0%): We estimate a 0.1% decline in May core retail sales (ex-autos, gasoline, and building materials; mom sa) following the 1.0% gain in April. Our forecast reflects tighter financial conditions, the continued goods-to-services demand shift, and some softening in high-frequency retail spending data for the month. We estimate a 0.5% drop in headline retail sales, reflecting sharply lower auto sales but higher auto prices and gasoline prices.

- 08:30 AM Import price index, May (consensus +1.1%, last flat): Export price index, May (consensus +1.3%, last +0.6%)

- 10:00 AM Business inventories, April (consensus +1.2%, last +2.0%)

- 10:00 AM NAHB housing market index, June (consensus 68, last 69)

- 02:00 PM FOMC statement, June 14-15 meeting: As discussed in our FOMC preview, we expect that the FOMC is likely to respond to the firmer May CPI print and the rise in long-term inflation expectations with a resolutely hawkish message, in addition to the 50bp rate hike it is set to deliver. This should come across clearly in the statement, the economic projections, and the dots. Our updated probability-weighted scenario analysis of possible funds rate paths implies that even our revised weighted-average view is a bit less hawkish than market pricing, following the large upward move in market pricing last Friday.

Thursday, June 16

- 08:30 AM Housing starts, May (GS -2.0%, consensus -1.0%, last -0.2%); Building permits, May (consensus -2.1%, last revised -3.0%): We estimate housing starts decreased by 2.0% in May, reflecting an increase in mortgage rates and a decrease in permits last month.

- 08:30 AM Philadelphia Fed manufacturing index, June (GS 9.0, consensus 5.0, last 2.6): We estimate that the Philadelphia Fed manufacturing index rebounded by 6.4pt to +9.0 in June, reflecting the easing in China covid lockdowns but a continued drag from the Russia-Ukraine War.

- 08:30 AM Initial jobless claims, week ended June 11 (GS 200k, consensus 215k, last 229k); Continuing jobless claims, week ended June 4 (consensus 1,301k, last 1,306k): We estimate initial jobless claims declined to 200k in the week ended June 11.

Friday, June 17

- 08:45 AM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will make welcoming remarks at an inaugural conference on the international role of the dollar hosted by the Fed. Text is expected to be provided, while Q&A is not anticipated. Recall that on May 17, Chair Powell said, “…what we need to see is clear and convincing evidence that inflation pressures are coming down. If we don’t see that, then we will have to consider to be more resolute. If we do see that, we can consider moving to a slower pace.”

- 09:15 AM Industrial production, May (GS +0.5%, consensus +0.4%, last +1.1%); Manufacturing production, May (GS +0.3%, consensus +0.3%, last +0.8%); Capacity utilization, May (GS 79.4%, consensus 79.2%, last 79.0%): We estimate industrial production rose by 0.5% in May, reflecting strong electric utilities and mining production. We estimate capacity utilization increased to 79.4%.

Source: DB, GS, BofA