BY TYLER DURDEN …

MONDAY, SEP 12, 2022 – 07:00 AM …

There’s only one focal point on this week’s calendar: the US CPI report tomorrow, the last before the Fed’s September 21st meeting. As DB’s Jim Reid reminds us, the Fed are now in their blackout period so that will reduce the central bank chatter somewhat this week. Following the recent leak trial balloon from the WSJ’s Nick Timiraous, most economists have now raised their forecast to a 75bps hike at next week’s meeting while keeping the terminal rate at 4.1% for early next year. They believe the risks are on the upside. Importantly for the Fed, on Friday, we will also get inflation expectations from the University of Michigan consumer survey. US Retail sales data on Thursday will also be closely watched too but is unlikely to move the dial for the Fed.

For US inflation, Wall Street economists expect a slight decline in the headline CPI number (-0.1% MoM) but an acceleration of +0.30% in core, which would continue the pattern from July’s reading (unchanged and +0.3%, respectively) which came in lower than expected. They believe the YoY headline CPI should fall five-tenths to 8.0%, while core should tick up a tenth to 6.1%.

The recent slump in commodities, with WTI firmly below $100 per barrel throughout the month, is likely to put downward pressure on the headline number as are gas prices being down -12% over the month. However, the resilience of the labor market is among the forces that could propel the core gauge higher. Expect a fair amount of attention on what now seems to be sharp falls in used cars after runaway price rises during covid. On the flip side, rents should continue to climb for a few more months before falling. So they’ll likely be a few opposing forces in the release.

Speaking of the consumer, we will get retail sales data for August on Thursday and DB economists expect a +0.6% MoM reading, up from last month’s flat print. As gasoline prices continue their downward trend, whether this assuages the inflationary pressures on consumer spending will be important. US PPI (Wednesday), business inventories and industrial production data (both Thursday) will provide more insight into supply-side pressures.

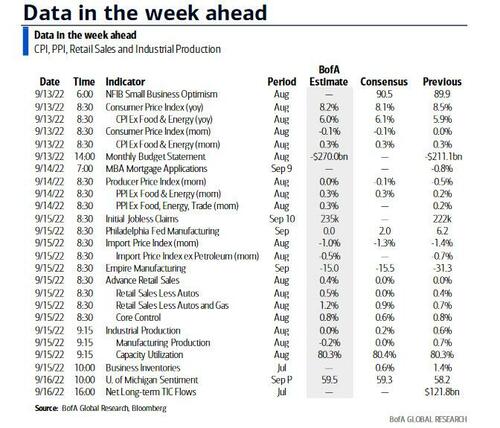

A snapshot of main events is below:

Turning to Europe now, and the BoE planned meeting has been postponed a week due to the period of mourning following the Queen’s death. However the UK will remain in the spotlight when it comes to economic data, with inflation (Wednesday), monthly GDP (today), retail sales (Friday) and labour market data (tomorrow) all due. For the record headline UK CPI is expected to stay at 10.1% YoY. Elsewhere in the region, we will also get the ZEW survey for Germany and the Eurozone tomorrow. Late on Friday our economists updated their GDP forecasts and with the NS1 gas shut off now looking terminal they expect 2023 GDP to fall -3 to -4%. To be fair their zero gas scenario earlier in the summer suggested -5 to -6% growth for 2023 but the impressive gas build over the intervening period means the worse case isn’t quite as bad as feared. Lots of moving parts though.

At the end of the week, an array of economic activity indicators will be out in China, in their usual monthly data dump, including industrial production, retail sales, new home prices and property investment (Friday). The gauges will follow this week’s downside surprises in trade data and inflation, so markets will be parsing the numbers to assess the magnitude of the economic softness. Our Chief China economist overviews the impact of China’s covid policy on its economy and mobility here and the team has downgraded their Q3 GDP forecast to 2.5% YoY (previously 3.5%).

Here is a day-by-day calendar of events, courtesy of Deutsche Bank:

Monday September 12

- Data: Japan August machine tool orders, UK July monthly GDP, construction output, industrial and manufacturing production, index of services, trade balance, Germany July current account balance, Italy July industrial production

- Central banks: ECB’s Schnabel and Guindos speak

Tuesday September 13

- Data: US August CPI, real average hourly earnings, NFIB Small Business Optimism, monthly Budget Statement, Germany and the Eurozone ZEW survey, UK August jobless claims change, July average weekly earnings, unemployment rate, Japan August PPI, Italy 2Q unemployment rate

Wednesday September 14

- Data: US PPI, Japan July core machine orders, capacity utilization, UK August CPI, RPI, PPI, July house price index, Eurozone July industrial production, Canada July manufacturing sales

Thursday September 15

- Data: US September Empire manufacturing index, Philadelphia Fed business outlook, August retail sales, industrial and manufacturing production, capacity utilisation, import and export price index, initial jobless claims, July business inventories, Japan August trade balance, July tertiary industry index, Germany August wholesale price index, Italy July general government debt, Eurozone July trade balance, Canada August existing home sales

- Central Banks: BoE decision, ECB’s Guindos and Centeno speak

Friday September 16

- Data: US University of Michigan survey, China August industrial production, jobless rate, fixed assets, new home prices, retail sales, property investment, UK August retail sales, EU27 August new car registrations, Italy July trade balance, Canada August housing starts, July wholesale trade sales

- Central banks: ECB’s Rehn speaks

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and Philadelphia Fed Manufacturing Index reports on Thursday. There are no scheduled speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, September 12

- There are no major economic data releases scheduled.

Tuesday, September 13

- 06:00 AM NFIB small business optimism, August (consensus 90.0, last 89.9)

- 08:30 AM CPI (mom), August (GS -0.13%, consensus -0.1%, last flat); Core CPI (mom), August (GS +0.32%, consensus +0.3%, last +0.3%); CPI (yoy), August (GS +8.02%, consensus +8.0%, last +8.5%); Core CPI (yoy), August (GS +6.06%, consensus +6.1%, last +5.9%): We estimate a 0.32% increase in August core CPI (mom sa), which would boost the year-on-year rate by two tenths to 6.1%. Our forecast reflects a further drop in airfares on the back of lower oil prices (we assume -5% mom sa) as well as net softness in autos categories (new +0.75%, used -1.25%, parts flat) due to easing supply chain constraints and the arrival of 2023 model years on dealer lots. However, we expect continued strength in services inflation due to wage pressures, labor shortages, and elevated short-term inflation expectations. Specifically, we look for a strong set of shelter readings (rent +0.65% and OER 0.55%) and a 0.6% rise in education prices due to higher tuition and daycare costs for the new school year. We also expect another gain in car insurance, as carriers push through price increases to offset higher repair and replacement costs. We estimate a 0.13% monthly decline in headline CPI, reflecting lower gasoline prices but higher food prices.

Wednesday, September 14

- 08:30 AM PPI final demand, August (GS -0.2%, consensus -0.1%, last -0.5%); PPI ex-food and energy, August (GS +0.2%, consensus +0.3%, last +0.2%); PPI ex-food, energy, and trade, August (GS +0.2%, consensus +0.3%, last +0.2%): We estimate a 0.2% increase for PPI ex-food and energy and PPI ex-food, energy, and trade. We estimate that headline PPI decreased by 0.2% in August, reflecting lower energy prices.

Thursday, September 15

- 08:30 AM Initial jobless claims, week ended September 10 (GS 235k, consensus 227k, last 222k); Continuing jobless claims, week ended September 3 (consensus 1,478k, last 1,473k): We estimate initial jobless claims increased to 235k in the week ended September 10.

- 08:30 AM Empire State manufacturing survey, September (consensus -15.0, last -31.3)

- 08:30 AM Retail sales, August (GS -0.3%, consensus flat, last flat); Retail sales ex-auto, August (GS -0.3%, consensus flat, last +0.4%); Retail sales ex-auto & gas, August (GS +0.4%, consensus +0.8%, last +0.7%); Core retail sales, August (GS +0.1%, consensus +0.5%, last +0.8%): We estimate core retail sales edged up by 0.1% in August (ex-autos, gasoline, and building materials; mom sa) following the 0.8% gain in July. Our forecast reflects payback in the nonstore category following record spending during Amazon Prime Day, which returned to July this year. However, high-frequency spending data indicates strong back-to-school demand for apparel and footwear as well as a further rise in restaurant spending, the latter of which is excluded from core retail sales but is included in the three higher-level aggregates. We estimate a 0.3% drop in headline retail sales, reflecting flattish auto sales but a sharp pullback in gasoline prices.

- 08:30 AM Philadelphia Fed manufacturing index, September (GS +1.0, consensus +3.0, last +6.2): We estimate that the Philadelphia Fed manufacturing index pulled back to +1.0 in September from +6.2 in August, reflecting weak European and East Asian demand.

- 08:30 AM Import price index, August (consensus -1.2%, last -1.4%)

- 09:15 AM Industrial production, August (GS -0.1, consensus +0.1%, last +0.6%); Manufacturing production, August (GS -0.2%, consensus -0.1%, last +0.7%); Capacity utilization, August (GS 80.1%, consensus 80.3%, last 80.3%): We estimate industrial production declined 0.1% in August, as strong oil production was likely offset by weak auto production and natural gas utilities. We estimate capacity utilization edged down to 80.1%.

- 10:00 AM Business inventories, July (consensus -0.6%, last +1.4%)

Friday, September 16

- 10:00 AM University of Michigan consumer sentiment, September preliminary (GS 58.5, consensus 59.5, last 58.2); University of Michigan 5-10-year inflation expectations, September preliminary (GS 2.8%, consensus 2.9%, last 2.9%): We expect that the University of Michigan consumer sentiment index ticked up by 0.3pt to 58.5 in the preliminary September report. We expect that the report’s measure of long-term inflation expectations edged down by 0.1pp to 2.8%, reflecting lower gasoline prices.

Source: DB, Goldman, BofA