BY TYLER DURDEN …

MONDAY, MAR 06, 2023 – 06:42 AM …

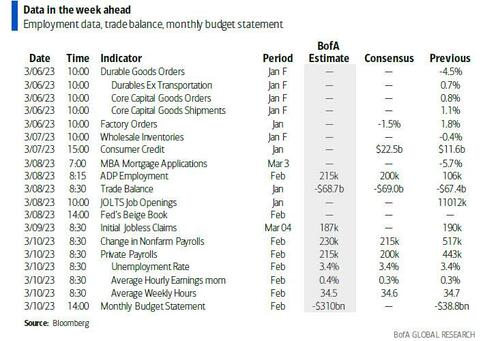

After a somewhat lazy start to March, we get a very busy 8 days for markets, culminating in the US CPI next Tuesday after payrolls this Friday, JOLTS and ADP on Wednesday, Claims on Thursday, and Powell getting things rolling tomorrow with his semi-annual monetary policy report to Congress. Here is a handy snapshot of the upcoming blizzard of events:

- Tuesday: Powell at 10am will appear before the Senate Banking Committee to deliver the first day of the semi-annual monetary policy report to Congress; RBA Rate Decision.

- Wednesday: ADP private employment at 8:15am (consensus 200k); JOLTS job openings at 10am (consensus 10,584k, last 11,012k) ; Powell speaks again at 10am; BOC Rate Decision.

- Thursday: Initial jobless claims at 8:30am (GS 190k, consensus 195k, last 190k); Barr (voter) at 10am;

- Friday: NFP at 8:30am (GS +250k, consensus +215k, last +517k); BOJ Rate Decision.

As DB’s Jim Reid writes in his weekly preview, it’s fairly uncontroversial to say that the last payrolls report published on February 3rd was a huge moment, and one that started a series of events that has meant that the last month has been a struggle for most financial assets, especially bonds (the worst February on record for the Global Agg). Remember that 36 hours before that payroll print, the relatively “dovish” FOMC had led to 10yr US yields hitting 3.33%. Last week at their peak they hit 4.08% before closing out at 3.95% on Friday.

As such if you thought the relatively random number generator that is payrolls is usually overhyped, you’ve seen nothing yet as we approach Friday’s big number. For those who have been on a sabbatical to another planet, last month it came in at +517k against +223k expected with fairly substantial upward revisions from the previous year as part of the annual review; most expectations however are for a reversal of the downward trendline as the January print was greatly influenced by one-time factors and seasonals.

Before we preview this, we should also say that other big highlights this week are the RBA (tomorrow), BoC (Wednesday) and BoJ meetings (Friday), and Powell’s semi-annual congressional testimony before House and Senate committees tomorrow and Wednesday. As discussed further below the BoJ is unlikely to change tack at this stage but every meeting is potentially live given what they did in December. We’ll review this and the rest of the week ahead after a brief payrolls preview.

For Friday DB’s economists expect +300k for both headline and private payrolls (consensus for both at +215k). As with January, February was also mild weather wise for the survey week (which can mean less leisure, hospitality and retail layoffs), although not as much as in the prior month. So the temperature will likely still be an influence. There was a reasonable question mark about seasonal distortions in the last report so who knows how that will impact this week’s report. Unemployment is expected to stay at 54-year lows of 3.4% with the risks it ticks down a tenth. We’ll give a fuller preview of average hourly earnings and the work week on Friday.

Don’t forget the JOLTs report on Wednesday which is viewed by many as a more accurate reflection of the tightness of the labor market with the main problem it always being a month behind the payroll report (we will have a note on this later today). Maybe it can help shed some light on how accurate January’s payrolls report was though. If it was accurate you should see an uptick in the hiring rate. Also important will be the job openings as usual to highlight the tightness in demand for labour.

Going back to the other highlights this week, Fed Chair Powell semi-annual testimony to the Senate Banking Committee tomorrow and to the House Financial Services Committee on Wednesday will of course be pored over for every subtle policy nuance. As they come before payrolls and next week’s equally crucial CPI report, it’s hard to see how he can be too confident about where the Fed is going to land. He may provide clues as to what employment and inflation numbers need to do to make the Fed act in a particular way, especially how it pertains to whether 50bps hikes are back on the table. Staying with central banks the RBA is seen as hiking 25bps tomorrow but the BoC seen as holding to their planned policy pause on Wednesday. Regarding this week’s BoJ meeting, consensus if for the central bank to adhere to its present monetary policy, with YCC removal seen unlikely, although you can’t rule it out given December’s surprise. This will also be the last monetary policy meeting for Governor Kuroda.

Other notable economic data releases in the US this week include factory orders (DB forecast -0.5% vs +1.8% in December) today, consumer credit tomorrow and the ADP and trade balance on Wednesday.

Turning to Europe, the focus will be on the UK with the release of the monthly GDP report on Friday, ahead of the March 23 BoE meeting. Elsewhere in the region, key releases include factory orders (tomorrow), retail sales and industrial production (Wednesday) for Germany and trade balance data for France (Friday).

In Asia the highlight might be the Chinese CPI and PPI reports due on Thursday. These will be released after last week’s blockbuster PMI readings showed a robust recovery and thus will be important to assessing the path of economic stimulus going forward. Our economists expect a 1.3% reading for the CPI (vs 2.1% in January) and a further YoY decline of -1.0% for the PPI (vs -0.8% in January).

On the earnings front, Q4 reporting season is now mostly over, but a few stragglers remain as shown in the table below.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 6

- Data: US January factory orders, UK February construction PMI, new car registrations, Japan January labor cash earnings, Germany February construction PMI, Eurozone January retail sales

Tuesday March 7

- Data: US January wholesale trade sales, consumer credit, China February trade balance, foreign reserves, Japan January trade balance BoP basis, Japan February bank lending, Germany January factory orders

- Central banks: Fed Chair Powell testifies to the Senate Banking Panel, ECB consumer expectations survey

Wednesday March 8

- Data: US February ADP report, January trade balance, JOLTS report, Japan February M2, M3, Economy Watchers survey, January leading and coincident index, Italy January retail sales, Germany January retail sales, industrial production, Canada January international merchandise trade

- Central banks: BoC decision, Fed Chair Powell testifies to the House Financial Service Committee, ECB’s Lagarde speaks, BoE’s Dhingra speaks

- Earnings: Adidas, Thales

Thursday March 9

- Data: US Q4 household change in net worth, initial jobless claims, China February CPI, PPI, money supply, Japan February PPI, machine tool orders, January household spending, France Q1 total payrolls

- Central banks: Fed’s Barr speaks, ECB’s Vujcic speaks, BoE’s Breeden speaks

- Earnings: Deutsche Post, Leonardo

Friday March 10

- Data: US February jobs report, monthly budget statement, UK January trade balance, monthly GDP, industrial and manufacturing production, index of services, construction output, Italy January PPI, France January trade balance, Canada February jobs report, Q4 capacity utilization

- Central banks: BoJ decision

* * *

Looking at just the US, Goldman writes that the key economic data releases this week are the JOLTS job openings on Wednesday and the employment situation report on Friday. Chair Powell will appear before the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday.

Monday, March 6

- 10:00 AM Factory orders, January (GS -2.0%, consensus -1.8%, last +1.8%); Durable goods orders, January final (last -4.5%); Durable goods orders ex-transportation, January final (last -1.2%); Core capital goods orders, January final (last +0.8%); Core capital goods shipments, January final (last +1.1%): We estimate that factory orders decreased 2.0% in January following a 1.8% increase in December.

Tuesday, March 7

- 10:00 AM Fed Chair Powell Speaks: Fed Chair Jerome Powell will appear before the Senate Banking Committee to deliver the first day of the semi-annual monetary policy report to Congress. Chair Powell’s prepared remarks will be released at 10:00 AM. The minutes to the February FOMC meeting, released February 22, noted that all participants continued to anticipate that “ongoing” rate increases would be appropriate going forward. “Some” participants noted that the easing in financial conditions over the previous few months “could necessitate a tighter stance of monetary policy.” Chair Powell last spoke in an interview with David Rubenstein on February 7.

- 10:00 AM Wholesale inventories, January final (consensus -0.4%, last -0.4%)

Wednesday, March 8

- 08:15 AM ADP employment report, February (GS +200k, consensus +200k, last +106k): We estimate a 200k rise in ADP payroll employment in February, reflecting strength in Big Data indicators but the persistent underperformance of ADP relative to nonfarm payrolls in recent months.

- 08:30 AM Trade balance, January (GS -$68.0bn, consensus -$69.0bn, last -$67.4bn): We estimate that the trade deficit widened to $68.0bn in January.

- 10:00 AM JOLTS job openings, January (GS 10,200k, consensus 10,584k, last 11,012k): We estimate that JOLTS job openings declined to 10,200k in January.

- 10:00 AM Fed Chair Powell Speaks: Fed Chair Jerome Powell will appear before the House Financial Services Committee to deliver the second day of his semi-annual monetary policy report to Congress.

Thursday, March 9

- 08:30 AM Initial jobless claims, week ended March 4 (GS 190k, consensus 195k, last 190k); Continuing jobless claims, week ended February 25 (consensus 1,659k, last 1,655k): We estimate that initial jobless claims were unchanged at 190k in the week ended March 4.

- 10:00 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will discuss crypto at an event hosted by the Peterson Institute for International Economics. Speech text and a moderated Q&A are expected, and the event will be livestreamed.

Friday, March 10

- 08:30 AM Nonfarm payroll employment, February (GS +250k, consensus +215k, last +517k); Private payroll employment, February (GS +240k, consensus +215k, last +443k); Average hourly earnings (mom), February (GS +0.30%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), February (GS +4.75%, consensus +4.7%, last +4.4%); Unemployment rate, February (GS 3.4%, consensus 3.4%, last 3.4%); Labor force participation rate, February (GS 62.4%, consensus 62.4%, last 62.4%): We estimate nonfarm payrolls rose by 250k in February (mom sa). Job growth tends to remain strong in February when the labor market is tight as some firms front-load spring hiring, and Big Data employment indicators were indeed strong in the month. We also expect high but falling US labor demand to more than offset rebounding layoffs in the information sector. We do not expect a large drag from weather in the February report. While temperatures partially normalized from an abnormally warm January, the February survey week exhibited little snowfall in major population centers, and the major winter storm of February 21st arrived three days after the end of the survey week. We estimate the unemployment rate was unchanged at 3.4%, reflecting a rise in household employment offset by flat-to-up labor force participation (we estimate unchanged on a rounded basis at 62.4%). We estimate a 0.30% increase in average hourly earnings (mom sa) that boosts the year-on-year rate to 4.75%, reflecting continued but waning wage pressures and neutral calendar effects.

Source: DB, BofA, Goldman